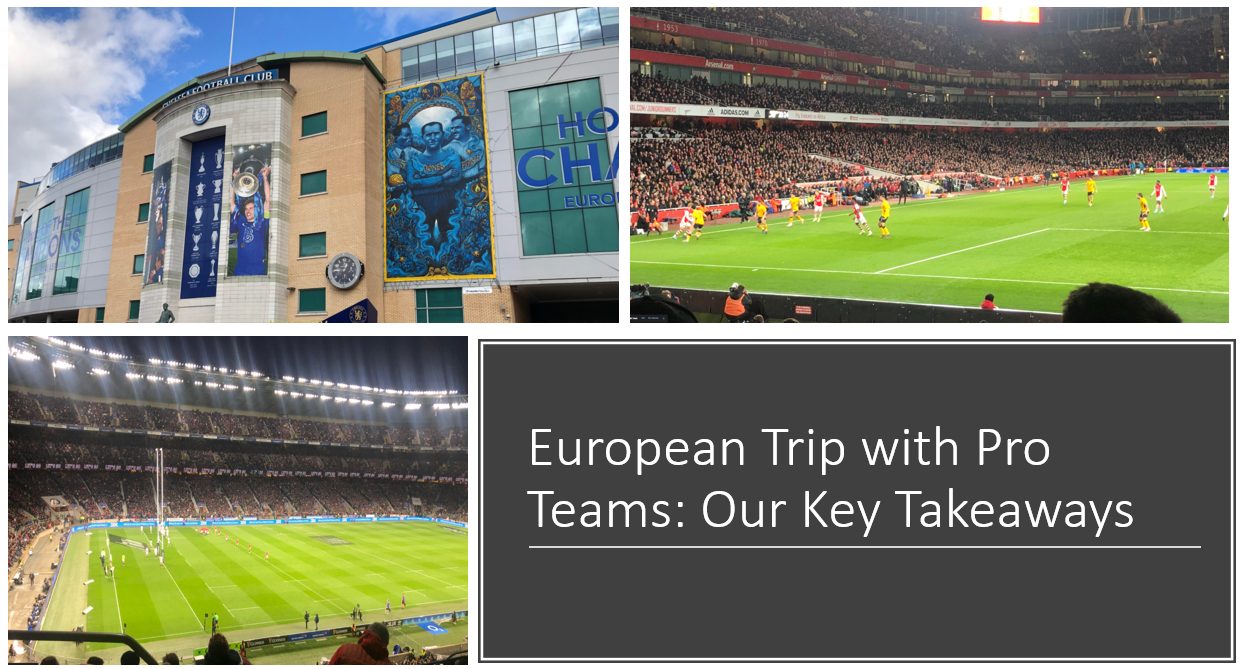

Last week we took a quick break to catch up with some top European clubs (Ligue 1, Premier League..), Olympic organizations and national teams to get a pulse on the latest sports tech trends impacting those sports organizations. We had numerous meetings with top coaches, athletic trainers, head of sports…

Share This Story, Choose Your Platform!

Total reviews

Persons recommended this product

Anonymous

Shopper

check_circle Verified

Shop owner replied

Anonymous

Shopper

check_circle Verified

Shop owner replied

Thanks for your review!

Your feedback helps us improve our service.

There are no reviews yet.

Be the first to review “ ”

Please log in to submit a review.

Don't have an account? Register here .

Only logged in customers who have purchased this product may leave a review