With 20+ leading GPS vendors (Catapult, STATSports, WIMU, McLloyd..) in the market today, GPS systems have become one of the most common tech used by pro teams today. Simply put, sports teams have to pick the right GPS system that fits their requirements, use cases, budget, and GPS accuracy requirements. In this analysis we will discuss the current and future market trends, VC/M&A investment trends, the GPS vendor ecosystems, and the key GPS vendors. We will also provide recommendations to pro teams looking to adopt a GPS solution.

What are GPS systems?

GPS systems, also known as Global Positioning System, have been used by pro teams for a long time. GPS systems, used in Player Tracking devices, enable teams to track players’ movement and measure data such as running speed, position on the pitch, distance run, and even their heart rate. Player Tracking devices typically use 4 types of sensors: an accelerometer, a gyro, a magnetometer and a GPS module.

Generally speaking, teams use Player Tracking devices to help them prevent injuries. By tracking a player’s sprints and distance covered the coaching staff can determine whether the player is fit for their next game or could benefit from resting.

These Player tracking systems are best when combining GPS metrics with other data points in order to get the full understanding of the players’ health.

The most common data point being collected are:

- Total distance covered

- Average running speed

- Total running distance (high pace)

- Total sprinting distance (full speed sprinting)

- Average acceleration time

- Average deceleration time

- Heart rate (to identify athlete’s work rate)

- Positioning on the field

- Time of high intensity play

- Time of low intensity play

- Athlete’s load (the demand on an athlete’s body)

- G-Force / impact data

Outdoor GPS market is dominated by some players like Catapult, and STATSports

In the GPS outdoor market, Catapult and STATSports are dominating. In fact, according to Upside Global’s internal data, Catapult and STATSports currently capture 50%+ of the GPS outdoor market. For example, Catapult has nearly 3000 customers today. In terms of brand recognition, both GPS vendors are top of mind among teams and leagues. However we are starting to get a sense, based on our conversations with pro teams, that many teams feel that those dominant players, especially Catapult, are a bit too expensive. This means that there is an opportunity for the emerging players to disrupt this market.

Emergence of smaller low cost players with good GPS accuracy and focusing on lower level leagues (SPT, McLloyd..)

Over the past few years we have seen the emergence of emerging GPS vendors which offer low cost GPS systems with good GPS accuracy. Unlike Catapult or STATSPorts which primarily focus on the world of elite sports, McLloyd and SPT essentially focus on High school, college teams as well as private coaches. Their GPS products are typically available for less than $5K per year (for 10 units) with payment flexibility and short term contracts. We expect those emerging players to continue to disrupt and gain traction at the lower end of the market in the coming years.

M&A activities are accelerating

In recent years the phenomenon of consolidation has accelerated in the GPS outdoor market. For example, Catapult acquired two startups. In 2020, Catapult acquired a subscription online sport learning platform, Science for Sport. Then last year, Catapult Catapult Sports bought SBG Sports Software (SBG), a global leader in video and data analysis to elite sports teams and motorsports. Through these acquisitions, Catapult was able to acquire new engineering talent, and new customers. But more importantly, the company was able to enhance its product offering in order to maintain its dominance. We also saw some GPS vendors teaming up with software providers in order to gain market share. It was the case of McLloyd who teamed up with ERP vendor MyCoach last year. Moving forward we expect M&As to accelerate.

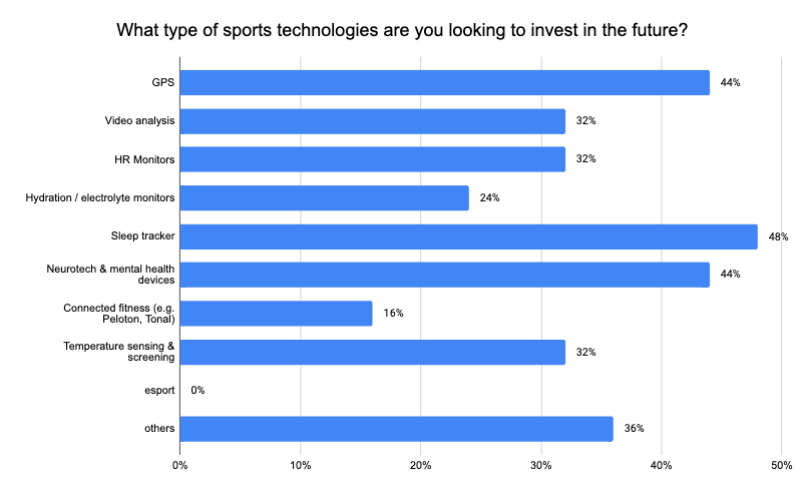

44% of athletic trainers plan to invest in GPS systems, according to the 2020 Upside Global survey

As shown in the graph below, 44% of the athletic trainers we surveyed last year are planning to invest in GPS systems in the future. This compares to 48% of the athletic trainers looking to invest in sleep trackers in the future.44% of them are also planning to invest in neurotech & mental health devices in the future. This does not come as a surprise as being on quarantine likely affected some players mentally and trainers want to make sure that they can address any mental issues moving forward. 32% of them are also planning to invest in HR monitors and video analysis systems. 32% of the athletic trainers are also looking to invest in temperature sensing & screening solutions.

Hydration/electrolyte monitoring solutions also gathered a lot of interest with 24% of the respondents indicating their plan to buy hydration/electrolyte monitoring solutions. Lastly, 16% of athletic trainers also indicated their plan to invest in connected fitness (Peloton, Tonal..) in the future.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, Confidential, April 2020.

Discrepancy in GPS accuracy between various vendors

Several studies have shown that there are discrepancies between GPS systems in terms of GPS accuracy. The most common factors affecting GPS accuracy include clock errors, ephemeris errors, atmospheric delays, multipathing and satellite geometry.

Remote monitoring, and mesh network driving adoption of smaller GPS vendors

In the outdoor GPS market, we are starting to see a number of smaller GPS vendors offering value added features and capabilities such as remote monitoring, and mesh network. This is the case of GPS vendors such as McLloyd. In our view, this is a nice way to differentiate their offering. Of note, remote monitoring is interesting especially in the context of COVID-19 where coaches are oftentimes trying to limit contacts with players. Creating a GPS system based on a mesh network is another great way to improve the accuracy of GPS measurements. In the future we expect more GPS vendors focusing on value added features in order to further gain market share.

GPS systems integrating more biosensing capabilities such as HR. Hydration measurement is next?

Over the past few years, we have also seen a number of GPS vendors offering GPS systems with biosensing capabilities such as HR measurement. This is the case of GPS vendors such as Polar. In the future we expect GPS vendors to go one step further and add new biosensing capabilities such as hydration, lactate, electrolyte, measurement and HRV sensing. It only makes sense to do so as it would allow teams to see the correlation between load and biometric data in order to better assess the health of players and prevent injuries.

Video analysis is becoming another great way for GPS vendors to differentiate

A growing number of GPS vendors also offer video analysis as it is a nice complement to GPS systems. The idea there is that you can also overlay the GPS data on top of the video analysis systems. Of note, this is partially the reason why market leader Catapult bought SBG a few years ago in order to remain competitive. We expect more GPS vendors to follow suit and offer video analysis in the future as a way to be on par with the competition and enhance their GPS offering.

3D/VR/AR based GPS system, another emerging trend among GPS vendors

Due to the growing adoption of VR solutions and VR headsets (Oculus Quest, PSV4..), a number of GPS vendors have started to add VR/3D capabilities to their GPS offering. For example, McLloyd built a 3D/VR/AR based GPS system allowing sports organizations to provide GPS data in 3D, AR, or VR to their fans. By doing so it helps enhance the fans’ experience. It also helps increase fan engagement. We expert other GPS vendors to offer similar capabilities in the future.

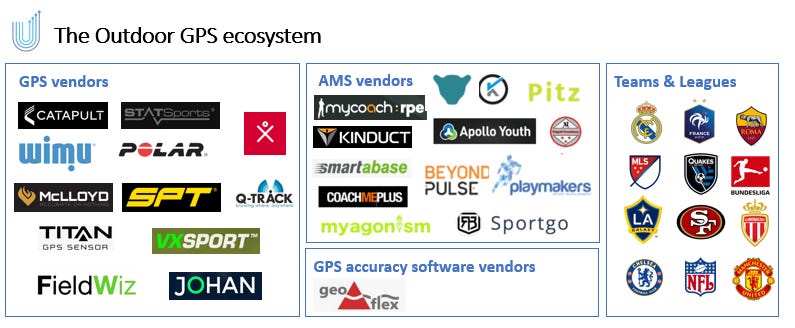

The outdoor GPS market ecosystem: From GPS vendors to AMS:

The outdoor GPS market is comprised of the following subsegments:

- GPS vendors: Typically those include companies manufacturing outdoor GPS systems. It includes vendors such as Catapult, STATSports, WIMU, McLloyd, SPT, Polar, Q-Track, Titan, Gpexe, VX Sport, FieldWiz/ASI, Johan Sports, among others.

- AMS (Athlete Management Systems) vendors: These are typically player assessment & performance tools used by coaches in training and live games. Some of these tools track and analyze statistical (video analysis, distance ran..) and performance data (GPS, workload, HR, Motion, hydration, fatigue..) via the use of wearables and GPS trackers. Key players in the space include companies like Beyond Pulse, Myagonism, Sportgo, Apollo Youth, Kitman labs, Kinduct, Smartabase, Yguara, Pitz, Edge11.

- GPS data accuracy software vendors: This includes vendors which provide special software enabling GPS providers to improve their GPS accuracy. This includes companies like ADI or Geoflex.

Source: Upside global Confidential, 2021

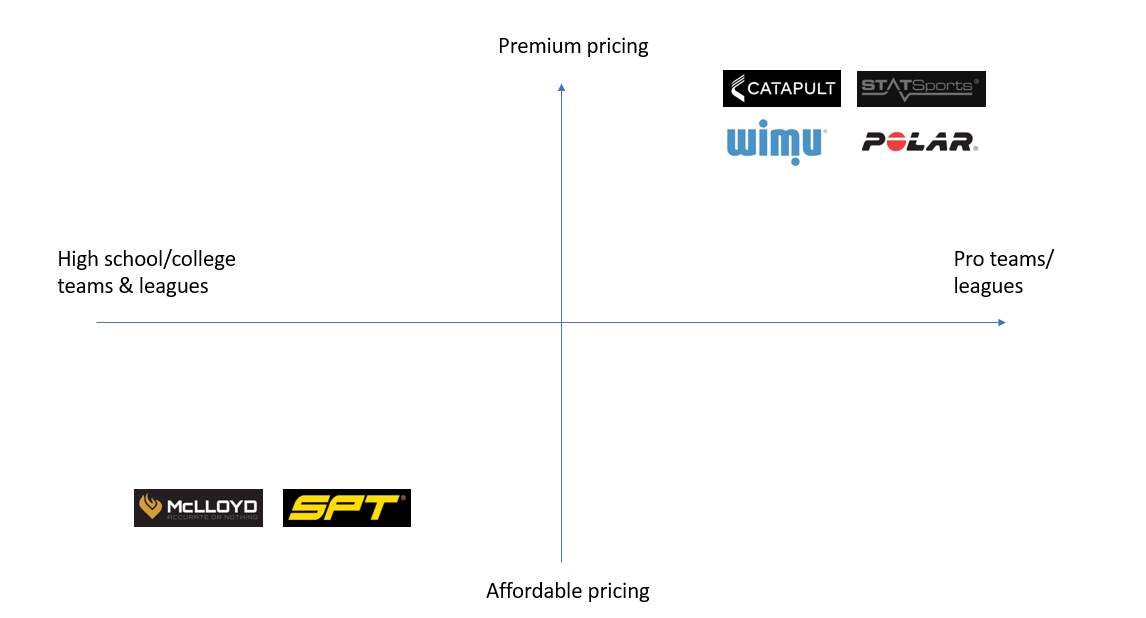

Now looking at the respective positioning of GPS vendors in terms of pricing strategy and targeted customers, we can categorize those GPS vendors in several groups:

- GPS vendors primarily, which target elite teams and charge a premium ($20k-$40k per year) for their GPS solution: Those include companies such as Catapult, STATSports, Polar, WIMU, to name a few.

- GPS vendors, which target low-mid level teams (High school, college teams, private coaches) and charge affordable pricing (<$5k for 10 units) for their GPS solution: Those include vendors such as McLloyd and SPT.

Source: Upside Global confidential, 2021

Also please note that on the chart above the purpose was not to show all the GPS vendors on the chart but to show some GPS vendors as a way to categorize GPS vendors.

Key outdoor GPS vendors

In the following section we will go over the main outdoor GPS vendors. Please keep in mind that this list is not meant to be exhaustive.

- Catapult

Founded: 2006

HQ: Melbourne, Victoria, Australia

Amount money raised: N/A (Public company)

Website: https://www.catapultsports.com/

Investors: Catapult is funded by Aura Ventures. Catapult has acquired 4 organizations. Their most recent acquisition was SBG Sports Software on Jun 23, 2021.

Total employees: 474

Customers / partners: 2970 customers. Bayern Munich FC, LA Galaxy (MLS), Wales Rugby and NFL’s Steelers, amongst others, use Catapult.

Company/product description: Catapult is a sports performance analytics company, listed on the Australian Stock Exchange, that provides performance technology to 2970 teams, across 39 sports, in 137 countries. The company is headquartered in Melbourne, Australia.

There are three physical products: Catapult Vector, the ClearSky T6 and Optimeye S5. Each of these pieces of hardware is worn by athletes to help track different elements of their performances.

ClearSky is a local positioning system (LPS) Catapult developed in conjunction with the Commonwealth Scientific and Industrial Research Organization (CSIRO) that delivers accurate positional and inertial data in varying environments.

Catapult also developed a goalkeeper monitor, the G5, which quantifies the direction and intensity of dives, jumps, accelerations/decelerations, changes of direction, repeat high intensity efforts, and time to recovery.

Through its acquisition of GPSports, XOS Digital, PlayerTek, SportsMedElite and Baseline Athlete Management Systems Catapult also offers video technology and GPS systems for semi-professional sports teams and amateur football players.

- STATSports

Founded: 2007

HQ: Newry, Newry and Mourne, United Kingdom

Amount money raised: TBD

Website: https://statsports.com/

Investors: TBD

Total employees: 124

Customers / partners: 1000 customers (PSG, Tottenham Hotspurs,, Liverpool, Juventus, England National soccer team, US national soccer team..)

Company/product description: STATSports STATSports has grown from its humble origins in Ireland to be the world-leading provider of GPS player tracking and analysis equipment. They now have offices in Ireland, London, Chicago and Florida. The STATSports APEX/Viper System is a customer driven platform. The user-friendly interface was designed and shaped alongside some of the world’s top strength coaches, medics and sports coaches. It is the only system to offer sports specific software for Football, Basketball, American Football, Rugby and Athletics.

- WIMU

Founded: 2008

HQ: Almeria, Andalucía (Spain)

Amount money raised: TBD

Website: https://www.wimu.es

Investors: FC Barcelona

Total employees: 29

Customers / partners: 400 customers (FC Barcelona, Real Madrid and the Spanish national team, Arsenal FC, Bundelsiga teams..)

Company/product description: WIMU is a Spanish GPS vendor. Its Spanish Elite Tracking System WIMU PRO is used by FC Barcelona, Real Madrid and the Spanish national team (amongst others). FIFA approved its GPS system for player tracking both indoor and outdoor.

Wireless wearable device with advanced sensors providing muscle oxygen levels, respiration and heart rate and presents all the data from compatible devices from one single platform.

- McLloyd

Founded: 2013

HQ: Paris (France), US subsidiary in Miami, FL (USA)

Amount money raised: 2M€

Website: https://mclloyd.com/

Investors: TBD

Total employees: 15

Customers / partners:

« Sport Performance » : 100+ customers in Europe (Stade Rennais. Standard de Liege, Amien SC…), North America (Florida’s PSG academy , Miami city, House of Athletes & SD legion. Etc.).

« Racing Tracking & Broadcast major clients » : PMU, France Galop, Le Trot, 52 Super Series, Professional Triathlete Organisation (PTO)

McLloyd was born in 2013 in France. Based on the growing demand for performance optimization tools in sport and the limitations of existing equipment, McLloyd has set itself the goal of bringing a technological breakthrough in this area. After 3 years of R & D and several million euros invested, a first World Rugby Compliant system was launched in 2016, propelling McLloyd as the leading supplier of French professional rugby (TOP14 / ProD2). Then in 2017, McLloyd won the international PMU bidding competition for 42 companies and is now the official tracking system supplier for the french gallop and trotting races (6000 races/year). Thus was born the first centimetric GPS tracker in the world compatible with the constraints of sport and racing due to its size and weight. This range of products for Horse Racing led to a new generation of high-accuracy trackers now used also on sailing (52 Super Series) and Triathlon (Professional Triathlete Organization) races.

In 2018 McLloyd opened a subsidiary in Miami, and today addresses the European, Asian and American markets of tracking in professional sports and racing.

McLloyd’s goal for the next 24 months is to keep growing and hope to reach 100 clients by the end of the year. They will also adapt their racing tracker (HPv2) for sport performance purposes with a new packaged solution.

They would like to do more than just providing data. Using GPS it’s a good step but knowing what to do with your data is the key in modern sport. They are trying to build a community of coaches that use their products and can exchange with other teams and staff.

They are known as a reference in matters of accuracy and robustness of the system but at the same time they have to remain affordable to be able to work with every team looking for performance.

- SPT

Founded: 2015

HQ: Melbourne, Australia & Austin, Texas

Amount money raised: $8.5M

Website: www.sptgps.com

Investors: Family Offices, Elite Australian Athletes (Leyton Heywitt..)

Total employees: 10+

Customers / partners: 75,000 Users, 3,300 teams across 120 countries.

Company/product description: SPT is the Australian market leader in the prosumer space for wearable and performance analytics. Launching in the USA in 2018, SPT has also become one of the College and High School go to technology choices. It simplifies the complex and provides an easy-to-use system for those looking to adopt technology to improve their sporting programs without spending their whole budget.

SPT’s business model simplifies the path to success. It allows teams at all levels and individuals looking to improve the ability to partner with SPT and use our patented hardware and analytics program (GameTraka®). GameTraka® is a leading analytics platform that provides a simple system and allows for customisation and complexities our top organisations can upgrade to. Premium offerings for all teams at the flick of a switch provides in-depth analysis or simple analysis – depending on the level of your program.

SPT’s goal for the next 24 months is to become the market leader in the USA as they are currently in Australia. Their system has recently been wholly re-launched with an updated design and more specific features for the customer. They bring the complex and turn it into simple decision making and powerful outputs for all programs. Their Division 1 colleges, global, national programs, and smaller high school and club development teams all find massive value in the SPT system.

- Polar

Founded: 1977

Amount money raised: TBD

Website: https://www.polar.com/

Investors: TBD

Total employees: 1200

Customers / partners: VFL Wolfsburg, South American soccer teams, Asian soccer teams, etc.

Company/product description: Polar is a manufacturer of sports training computers, particularly known for developing the world’s first wireless HR monitor.

The company is based in Kempele, Finland and was founded in 1977. Polar has approximately 1,200 employees worldwide, it has 26 subsidiaries that supply over 35,000 retail outlets in more than 80 countries. Polar manufactures a range of heart rate monitoring devices and accessories for athletic training and fitness and also to measure HRV.

Designed for professional team sports, Polar Team Pro combines high-precision GPS-derived movement data, inertial sensor metrics and integrated heart rate monitoring into a mobile and easy-to-use wearable player tracking system.

- Q-Track

Founded: 2002

HQ: Huntsville, Alabama, United States

Amount money raised: TBD

Website:https://q-track.com/sports-tracking/

Investors: TBD

Total employees: 7

Customers / partners: South American soccer teams, etc.

Q-Track is applying its precision indoor location technology to accurately and objectively measure athlete performance. The Sports Medicine Assessment Tool (SMAT) provides comprehensive kinematic and physiological data to trainers, coaching staff, and athletes alike. SMAT allows for a quantitative assessment of training intensity providing for maximum performance while minimizing injuries. The result is a better prepared more competitive team.

- Titan

Founded: 2004

Amount money raised: TBD

Website: https://titangps.com/

Investors: TBD

Total employees: 54

Customers / partners: European soccer teams, etc.

Titan GPS design, develop, manufacture, and support end-to-end GPS location and fleet management telematics technology. Certified Tracking Solutions design, develop, manufacture, and support end-to-end GPS location and fleet management telematics technology under the brand name Titan GPS. Titan GPS is a trusted partner to thousands of fleet customers in the public sector, field service, winter maintenance, transportation, construction, transit, auto dealer, and OEMmarkets across North America, including particularly strong relationships with municipalities throughout Alberta.

- Gpexe / Exelio

Founded: 2009

HQ: Udine, Italy

Amount money raised: TBD

Website: https://www.exelio.eu

Investors: TBD

Total employees: 18

Customers / partners: 150+ teams (AC Milan, Inter Milan, Sampdoria, AS Monaco, etc.)

Gpexe is a GPS system manufactured by Exelio. Gpexe is a tracking system for team sports performance analysis, working through a high sampling rate GPS receiver. The majority of the Italian Serie A teams, over 150 clubs and National Teams worldwide, use Gpexe.

Their strength in the market can be attributed by its 20 Hz device frequency, much higher frequency devices than that of most of its competitors. This is due to the fact that they only have one GPS reference (no Galileo, no glonass). Other GPS vendors are multiple constellations which is why they can only use a 10 Hz device frequency. With this high frequency GPEXE achieves a higher accuracy of information when tracking a player’s changes in speed and direction, something a lot of providers struggle to do with lower frequencies.

- VX Sports

Founded: 2007

HQ: Louisiana, USA

Amount money raised: TBD

Website: https://vxsport.com/

Investors: TBD

Total employees: 6

Customers / partners: NCAA teams.

VX Sport athlete monitoring products are used by world leading teams to drive performance decision-making. Only the VX System combines the tracking of physical and readiness data with simple planning tools that empower coaches to improve athlete performance. VX Sport provides the most accurate and affordable athlete monitoring solution.

- FieldWiz / ASI

Founded: 2012

HQ: Lausanne (Switzerland)

Amount money raised: CHF655K

Website: https://www.asi.swiss

Investors: FieldWiz is funded by 2 investors. Business Angels Switzerland (BAS) and Foundation for Technological Innovation (FIT) are the most recent investors.

Total employees: 18

Customers / partners: Swiss soccer teams, Belgium soccer teams, FFR XIII, among others.

Based on the joint passion for sports and technology of its founders, Advanced Sport Instruments SA (FieldWiz) is specializing in the development of electronic performance and tracking solutions. At the core of the company is a team dedicated to reimagining how technology can be leveraged to improve the performance of elite athletes. Advanced Sport Instruments works with hundreds of organizations and brands around the world like nation winter sport federations, football club from Champions League level to ambitious amateur teams, motorbike racing and adventure sports solutions. The company was the first to obtain the FIFA IMS certification for its solutions.

- Johan Sports

Founded: 2014

HQ: Noordwijk, Zuid-Holland, The Netherlands

Amount money raised: TBD

Website: https://www.johansports.com/

Investors: TBD

Total employees: 7

Customers / partners: South American soccer teams, etc.

JOHAN Sports offers an easy-to-use, affordable and practical performance tracking and analytics solution for field sports.

JOHAN serves field sport teams, both coaches, trainers, players and club management. They focus on teams with a medium to small staff, which generally have little to none scientific staff like data analysts and sports scientists. Although they provide all the raw data and statistics, most of their users need the relevant context of this data such that they can put it into practice. This way complex science and technology becomes available to every type and level of trainer.

Recommendations to teams and leagues looking to adopt an outdoor GPS solution

Here are some recommendations for teams or leagues looking to adopt a GPS solution:

- Ask yourself some key questions and assess your ideal game style: Teams need to ask themselves some key questions before adopting a GPS solution.

“Take the time to ask key questions and assess your ideal game style, athlete makeup and squad goals. Ask how GPS data would inform this”, recommended Ben Sharpe, Product development manager at SPT, during an interview with Upside Global.

More precisely, teams could answer the following questions:

“Teams need to answer the following questions: Requirements of the GPS system in terms of quality/accuracy, software quality, the types of data needed, the number of GPS systems needed, the need to use live cardio or not, the type of GPS (indoor or outdoor) needed, the monthly budget. This will help the team determine which GPS system is the best fit for them”, explained Laurent Debrousse, the head of McLloyd North America, during an interview with Upside Global.

- Adopt a GPS system that fits your actual needs: It is critical for teams to pick a GPS system to meet their needs.

“Consider your actual needs, some systems that require a large amount of staff hours may in fact carry too much functionality that does not get used. Ask your coaching staff what they need from a system”, recommended Ben Sharpe, Product development manager at SPT, during an interview with Upside Global.

- Make sure to mix the GPS data with other data points to get a better picture of the athletes’ health: As we mentioned earlier, it is critical for teams to aggregate their GPS data and mix it with other types of biometric data such as HR, HRV, etc. By doing so, it will give the coach a better sense of the health of his/her players.

“Don’t over complicate or over rely on one single metric or data point. Embed any technology as part of a holistic monitoring and performance tracking ecosystem’, recommended Ben Sharpe, Product development manager at SPT, during an interview with Upside Global.

- Adopt a data visualization software in order to better visualize the GPS data: Many times GPS vendors do not offer good data visualization software as part of their GPS offering. This is why it is important for teams to adopt data visualization tools provided by companies such as Rock Daisy in order to help them better visualize the GPS data.

- Adopt an injury prevention software in order to prevent injuries: Adopting an injury prevention software that will aggregate both the GPS data as well as other types of biometric data (HR, hydration, electrolyte, sleep data/HRV..) in order to fully assess the risk of injury per player, is absolutely critical. Injury prevention software such as Kitman Labs, use advanced algorithms which help identify patents, and baseline of each player, and therefore can identify when a player is at high risk of injuries based on increased load, increased body temperature, poor sleep quality, or other factors.

- Adopt a GPS system that fits into your workflow: This is probably one of the most important points. Whatever GPS solution a team decides to adopt the GPS system needs to fit into the team’s workflow, meaning that it should not disrupt the routine of the athletic staff, players and make them less productive. Those GPS systems should be easy to use, intuitive, and easy for the players to wear. Overall, if a GPS system does not meet those criteria it is probably not a good fit for a team.

- Make sure to have staff members (GPS analysts, sports scientists) that can manage your GPS systems on a daily basis: Teams also need to have a dedicated person on staff responsible for the GPS system. In some cases a GPS analyst would be required to analyse the GPS data if the GPS system does not provide good insights.

- Focus on GPS vendors with great customer service: This is another key factor when buying a GPS system. It is important for the team to adopt a GPS system with great customer service. Some GPS vendors provide staff members who can go on the customer’s site in order to assist teams with any problems. Some GPS vendors even have the ability to build custom data to teams. These are the type of GPS vendors that teams need to work with when adopting a GPS system.

- Focus on GPS vendors with remote monitoring: In the pandemic world that we are living in, it is also important for teams to work with GPS vendors who can provide remote monitoring, meaning the ability for coaches to remotely monitor their players. GPS vendors such as McLloyd offer such capability.

- Focus on GPS vendors with affordable pricing without long term contracts: Oftentimes we hear from teams that they are locked into long term contracts by some GPS vendors. Therefore it is important for teams to look for GPS vendors that offer pricing flexibility (1 year contract or monthly payment) as well as affordable pricing options based on the teams’ needs. GPS vendors such as McLloyd fall into this category.

- Focus on GPS vendors with value add services (AR/3D/MR..): As we mentioned before, working with a GPS vendor that can visualize the GPS data in AR/VR/3D in order to better understand and visualize the GPS data is critical as well. Companies such as McLloyd have such capability today.

Bottom line: Outdoor GPS systems have become a must have for sports such as soccer, or American football. Teams can choose from a wild variety of GPS vendors today. It is critical for sports teams to carefully assess those GPS vendors in terms of pricing, product quality, GPS accuracy, and vision of the management team, and other factors. Moving forward we expect M&A activities in the outdoor GPS market to accelerate. We also expect new emerging players to enter the market in order to disrupt the dominance of the incumbents. This will help fuel innovation in the GPS market which will be a win win situation for the teams and GPS vendors.

Leave A Comment

You must be logged in to post a comment.