Up until now the NBA has not allowed the use of wearables during live NBA games. But we believe that this will soon change thanks to sports betting. In this analysis we will explain the state of wearables in the NBA and other sports leagues, how sports betting will be a game changer, and how others leagues such as the NFL are now all in with sports betting as they see a new significant revenue opportunity, and a way to recover from the negative impact of COVID-19.

Wearables are still not allowed during live NBA games. The NBA only allows wearables in practice and in the G League

Currently the NBA does not allow any teams to use wearable during live NBA games. The league only allows NBA teams during practice or the G League. The NBA has even been very strict towards NBA players who tried to use wearables during live games in the past and it backfired. In fact, a few years ago, Matthew Dellavedova, point guard for the Cleveland Cavaliers, wore the Whoop wearable on his wrist for 15 games. After the NBA was informed about the presence of the wearable on Dellavedova’s wrist, he avoided a hefty fine but was banned from strapping it on again. This is the typical example of what the situation is regarding the use of wearables during live games.

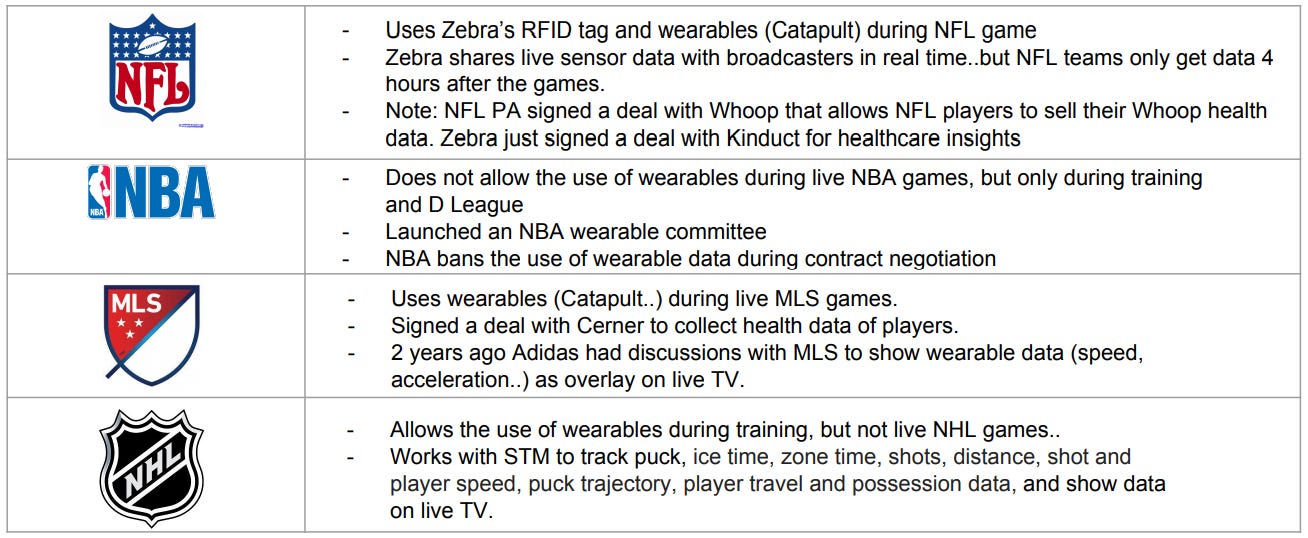

Other sports leagues such as the MLB & NFL allow the use of wearables during live games

In North America the NBA is one of the few major sports leagues that does not allow the use of wearables during live games. As shown in the table below, the MLB allows 3 wearables (Whoop, Zephyr, Motus) to be used during live games. The NFL also allows teams to wear wearables during live games. For example NFL players are equipped with Zebra’s RFID chips to measure the players’ speed, acceleration, velocity, and more. NFL teams also use wearables from companies like Plantiga a smart insole startup during live NFL games. In the MLS, teams are allowed to use GPS systems but it is the player’s choice to agree to wear the GPS system or not during live games.

Source: Upside Global confidential, 2021.

NBPA teamed up with wearables startups such as Whoop

Players associations such as the NBPA has teamed up with a number of wearable startups. One of the startups they teamed up with is Whoop, a leading wearable startup that just raised $400M. The idea there is that NBA players are in control of their wearable data and have the right to sell their data to monetize it.

NBAPA president Chris Paul has been an advocate for Whoop over the years. Please note that Whoop has signed a similar deal with the NFLPA.

NBA agents and players concerned about NBA teams using Wearable data to negotiate contracts

Historically NBA agents, and the NBAPA have been opposed to the idea of having NBA teams use wearables during live games by fear that NBA teams could use the wearable data to negotiate contract and see if a player’s health is deteriorating. In our opinion, that’s a reasonable concern.

But the NBA, NBA Agents and NBPA could embrace sports betting and the use of wearable data if they receive a cut of the sports betting revenue

We are now told by an NBA executive that if the NBA, and NBAPA would receive a cut of the sports betting revenues they would most likely embrace the use of wearables during live games to make it happen. We believe this is a reasonable assumption.

Wearable data + AR + AI digital coaching, during live game, set to be the killer use case for NBA coaching staffs

Here is what we believe will be among the killer use cases for the world of elite sports in the coming years, with sports betting at the core:

As we noted in some previous analysis, in the future, in the 5G era, we expect to see the emergence of 5G AR/Mixed Reality experiences with live players’ wearable data/biometric and statistical data and live betting capabilities.

Nowadays we are already seeing glimpse of what this type of fans experience could look like. ShotTracker currently has an AR app which allows fans at a stadium to hold their phone and look at a player on the field and see their statistical and biometric data just as an AR overlay simply by looking at them at a live sports event. You can see below the ShotTracker AR app and watch the video of this AR app here.

We also think that live betting will become a key part of the augmented video experience. The idea here again is to allow fans to watch augmented video replays and bet on the next play, and compete with their friends in real-time during live games. Companies such as WSC Sports, a leading player in the AI based video highlights space, are set to play a key role there. Ultimately this will enhance the fans experience, increase fans engagement, drive ticket sales, and teams’ top line.

Wearable data + sports betting, the next big revenue opportunity for the NBA and other major sports leagues.

As noted earlier, we recently sat down with a top NBA exec who believes that we could soon see the NBA allow the use of wearables during live games. His belief is that sports betting will be the biggest driver for NBA teams, NBAPA to allow it. Why? NBA agents, players and NBAPA would allow it if they get a cut of the sports betting revenue opportunity.

The NFL making big bets on sports betting. Expected to make $270M from sports betting this year.

NFL, who historically, has been against sports betting, is the perfect example of a league who has historically against sports betting and is now all in.

“It’s like turning the ship 180 degrees from where the NFL was, but they’ve embraced it, and it’s absolutely the right move,” said Trey Wingo, former host of the “NFL Live”. “At the end of the day, money is money, and the NFL is really good at making money.”, continued Wingo. Please note that Trey Wingo is now the chief trends officer and brand ambassador for Caesars Entertainment.

The NFL has been very active in this sports betting space, teaming up with betting operators, infusing broadcasts with gambling content and allowing betting to seep into the stadium experience. In April, the league announced partnerships with Caesars, DraftKings and FanDuel as its official sports-betting partners.

So how much revenue is the NFL expected to generate from sports betting this year? The league is expected to generate $270M in revenue this year from their sports-betting and gambling deals, according to a person familiar with the league’s finances.

“You can definitely see the market growing to $1 billion-plus of league opportunity over this decade,” said Christopher Halpin, an executive vice president for the NFL who is its chief strategy and growth officer.

In fact, bettors could place over $20B in football-related wagers this season. This would result in $1.5B in revenue for sportsbooks, according to industry analyst PlayUSA. Here are a few more details:

- PlayUSA projects at least $12B in NFL-related bets, excluding parlay bets, yielding at least $800M in sportsbook revenue.

- It also predicts at least $8B in non-parlay college football bets, bringing $550M to sportsbooks.

- The Fiesta Bowl and Guaranteed Rate Bowl also teamed up with Caesars Entertainment this year as college football warms to sports betting.

Football betting could help sports betting companies become profitable

Now sports betting companies have not all been profitable. In fact, DraftKings lost $305.5M in the second quarter, despite revenue nearly tripling YoY. Caesars’ sports betting and online gaming division also lost $22M in Q2. In addition, FanDuel parent Flutter Entertainment does not expect its U.S. division to turn a profit until 2023.

A report by Ibis World in 2018 roughly estimated that fully legal sports betting in the US would be worth an annual $55B. In the same year, the American Gaming Association pegged the illegal gambling market at $150B.

Based on all this it is quite clear that sports betting present a big opportunity for both the teams, leagues and sports betting companies.

NFL: 21 yo+ are frequent sports betters.

The NFL estimated that among its fans age 21 and older, roughly 20% were frequent sports bettors. 30% were casual or aspiring sports bettors, saying they would bet some in their state if it was legal but they were not going to bet illegally. Another 30% did not care, and 20% were what the NFL called “active rejecters.” The percentage of active rejecters fell each year that the NFL did such research, now landing around 12%.

The frequent sports bettors were mostly young and male. The active rejecters were about 60% female and, overwhelmingly, over age 55.

Other leagues (MLS, NHL, AFL, etc..) set to follow suit

We believe that once a major sports league takes the lead and start monetizing sports betting, combined with wearable data in a big way, all the major sports leagues in the world will follow suit. This is especially relevant in the pandemic world that we are still living in where sports leagues are looking for new major revenue opportunities to mitigate the impact of COVID-19.

Bottom line: At the end of the day, if there is a financial incentive, we believe that most leagues, players associations, agents, will be less concerned about the use of wearable data for players’ contract negotiations. This is why we believe that sports betting will be a real catalyst for this. It will unlock new revenue opportunities for both the players and the teams. While soccer clubs like Barcelona FC reported 1.3B euros losses, sports betting offers a unique opportunity to help clubs mitigate the impact of COVID-19. It will also help bring sports betting to the next level. In the long run we expect most sports leagues to embrace the use of wearable data as part of the sports betting experience.

Leave A Comment

You must be logged in to post a comment.