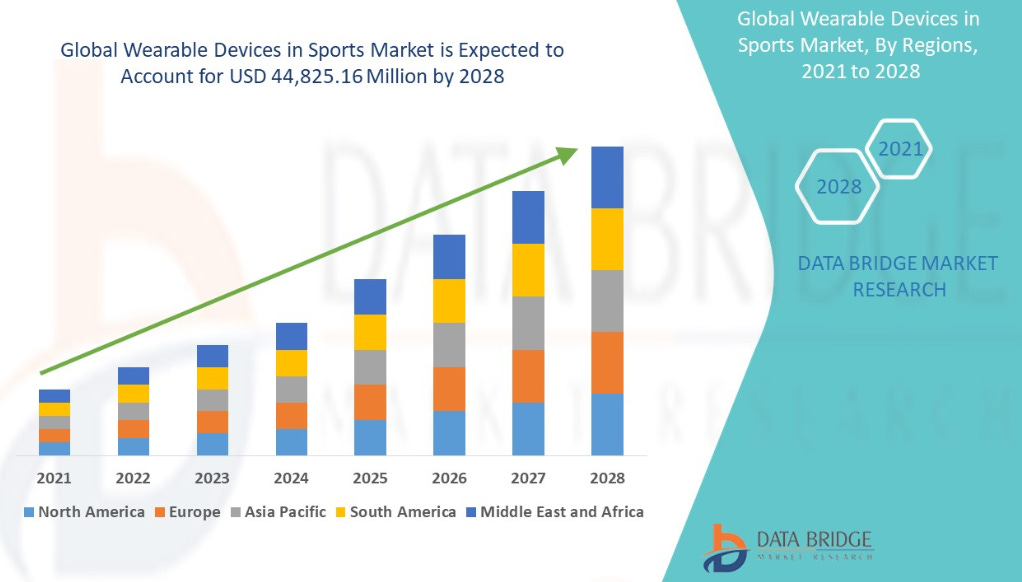

In the past few years, the world of sports has seen the emergence of a new wave of advanced wearables such as smart patches that can measure hydration or electrolyte, level, smartwatch that can measure blood pressure, or even contactless biosensors capable of measuring HR, blood pressure, sleep quality without any contact to the skin. As shown in the graph below, the wearable device sports market is now expected to reach $44.8B by 2028, according to Data Bridge Market Research. On top of that we are seeing the emergence of advanced algorithms capable of predicting the risk of injuries with high level of accuracy. This is having a profound impact on pro teams in terms of players’ monitoring, recovery or injury prevention.

In professional sport, as we mentioned before, the amounts spent on wages lost when players are unavailable for selection justify employing a whole army of injury prevention experts!

As an example, as we noted before, an average team in the English Premier League pays an estimated $12M in wages to players who are unavailable for selection due to injury over the course of one season(12). In addition, the resulting loss of league points contributes another $48M in lost potential income(12). Similar results are evident across other professional sports leagues (see figure 3). While injuries in amateur sport do not result in wasted salary payments, personal cost can be high. An organization sponsoring multiple teams (schools, universities, clubs) could provide tangible benefits to their members if they employed a sports injury prevention professional.

Picture: Financial losses and games lost due to injury

Looking at the cost of injuries globally, soccer is currently the sports that is the most impact by injuries. As shown in the graph below, injuries have cost $6.2B across all the soccer teams in 2015. The second most impacted sports is baseball with a total of $3.3B in terms of cost of injuries. Just to put things into perspective, in Europe, it costs $600,000 per month per player for major European soccer teams to cover the cost of injuries. This typically includes the cost of salaries, medical procedures and the insurance cost.

Source: Upside Global, 2022

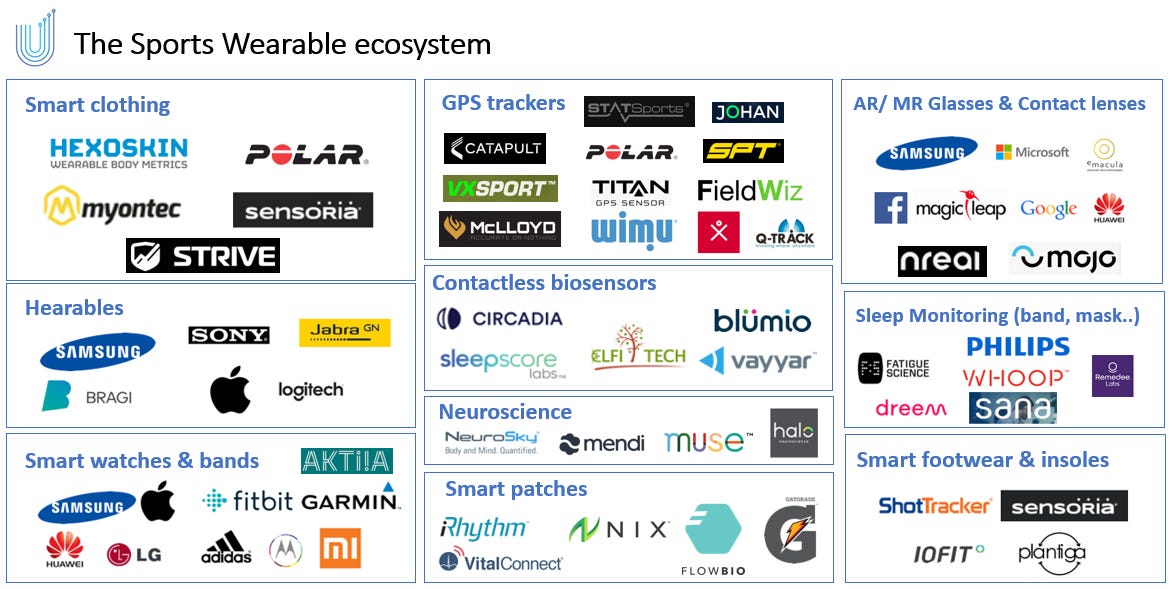

In this analysis, we’ll provide an overview of the key wearable sports segments, the key players, and current and future trends.

Let’s start by defining the key wearable sports segments:

(1) Smart clothing: This typically includes smart t-shirts or smart shorts embedded with sensors capable of measuring athletes’ biometric data (HR, HRV, workload, fatigue, breathing, and more). Key players include companies like Hexoskin, Polar, Sensoria, Strive, or Myontec.

(2) Hearables: This category can be defined as smart earbuds that can be worn into the ears. Some of those models can also track biometric data (e.g. HR, blood pressure). Companies like Samsung, Apple, Sony, Jabra, Logitech, Bragi, are among key players there.

(3) Smartwatches & fitness bands: This typically includes watches or fitness bands embedded with sensors capable of measuring users’ biometric data (HR, Blood pressure, HRV, sleep quality, fatigue, steps, calories, etc.). Leading players here are companies like Samsung, Apple, Fitbit, Garmin, adidas, LG, Huawei, Motorola, Aktiia, among others.

(4) GPS trackers: These are typically devices that can be worn on the body and track GPS (location..) as well as workload, speed, and more. It includes vendors such as Catapult, STATSports, WIMU, McLloyd, SPT, Polar, Q-Track, Titan, Gpexe, VX Sport, FieldWiz/ASI, Johan Sports, among others. You can check out our full analysis on the GPS market here.

(5) Neuroscience: These are technologies that enable the visualization of brain wave activities as well as the measurement of data such as ECG. It can be typically worn on the head and can also be used to measure biofeedback to help athletes relax and be in the zone when they need to perform during sports events. Key players are Muse, Mendi, or NeuroSky, among others. And companies like Halo also built a neuroscience based device enabling athletes to increase neuroplasticity.

(6) Smart patches: These are typically patches that can be worn on the body and that are capable of measuring the athletes’ biometric data (e.g. HR, sweat rate, electrolyte, core body temperature, sodium, potassium, Ph..). The key players there include companies like Flowbio, Gatorade, iRythm, BioBeat, Masimo, Nix Biosensors, Vital Connect. Please note that all these vendors are capable of measuring all these metrics.

(7) AR/MR glasses and contact lenses: These are typically smart glasses or smart contact lenses that users can wear on their face or their eye and are capable of displaying information to the user as an AR overlay. The goal here is to augment the user’s vision. In this case, an athlete could be wearing a pair of smart glasses and see his/her speed, distance ran, and biometric data (HR, fatigue level..) in real time through the smart glasses or lenses. Key vendors in this space are companies like Magic Leap, Samsung, Microsoft, Facebook/Oculus, Huawei, Innovega, Mojo Vision, and Google.

(8) Contactless biosensors based devices: These are typically devices that are embedded with a tiny radar (based on technologies like UWB) and advanced algorithms that can measure athletes’ biometric data (e.g. HR, sleep apnea, stress, anxiety, HRV, blood pressure, etc) without any contact to the skin. Leading players in the space include companies like Vayyar, SleepScore, Blumio, Elfi Tech, Circadia Tech, and Xandar Kardian.

(9) Sleep monitoring: These are usually smart devices (e.g. mask, headband, watch..) capable of monitoring the athletes’ sleep and even making them fall sleep. For example Sana built a smart sleeping mask that uses pulses of lights and sounds and can make athletes sleep in 15 minutes. Other companies focusing on this area include companies like Remedee Labs (wristband), Fatigue Science (watch), Dreem (headband), Philips, Whoop (Watch), to name a few.

(10) Smart footwear & insoles: This category usually includes smart footwear (smart shoes, insoles) capable of measuring the athletes’ mapping pressure and more in order to help avoid foot injuries. IOFIT and Sensoria are leading makers of smart shoes. Plantiga makes smart insoles and ShotTracker makes a shoe tracker to track players’ performance.

Source: Upside Global, 2022

1. Contactless biosensors set to become the new norm for sleep monitoring among the world of elite sports.

⬆️ The Upside: Let’s face it! Athletes are very particular about their sleep. Wearing smartwatches, headbands or any other wearables to monitor their sleep is a no go in our opinion. This is why we believe that devices using contactless biosensors capable measuring the sleep (light, deep sleep, REMs..) is the way to go. In fact, we work with many pro teams and based on our feedback teams prefer using devices using contactless biosensors simply because it is more convenient for the athletes and it makes the coaches’ job easier. We have come across many devices using contactless biosensors and the best product (see picture below) that we have seen and tested is SleepScore Max. The device was very convenient to use as we only needed to put it on our bedside table. It was also incredibly accurate in terms of sleep measurement as it was able to measure our light, deep sleep accurately.

Picture: SleepScore Max

We expect most pro and Olympic teams to use those types of devices using contactless biosensors in the future simply because it is a lot more convenient than having to wear a watch, headband or a ring to measure sleep quality.

2.Next generation wearable capable of providing relevant insights and even detect early signs of chronic diseases, will separate themselves from the pack.

⬆️ The Upside: The holy grail of wearable health and sports products is to be able to analyze a large amount of data, makes of it all and detect early signs of chronic diseases. This is why we believe that in the next 2-3 years we will see the emergence of next gen wearables capable of detecting early signs of chronic diseases such as diabetes, or blood pressure. This will be made possible by the use of advanced algorithms and biosensors. For example Apple is rumored to be working on a new type of wearable device capable of measuring glucose level. Such move would allow Apple to go after the $36B diabetes devices market. Apple has a big advantage there as it will be able to leverage its massive iOS (1B+ users) install base and fast-growing Apple watch user base. Let’s face it, Apple, which added ECG measurement to its Apple Watch, is looking to capitalize on its lead in the smart watch market and launch this type of wearable to go after this new market, enter a new category and drive its top line. This would make a lot of sense. Apple is also looking to add blood pressure measuring capabilities by 2025.

Like Apple, Fitbit is focusing on making sense of its users’ data to generate data and improve stickiness. Back in 2019, during a Fitbit earnings call, Fitbit CEO said:

“At a very high level, the vision for our premium offering is a service that uses and gathers Fitbit data and data from other sources to screen and diagnose different disease and health conditions for users, that analyzes this data to give people richer and deeper insights about their health, and also provides coaching and guidance,” says Fitbit CEO Park. “Next steps are for people to address their health conditions or to reach their fitness and wellness goals.”

But Apple and Fitbit are not the only companies or institutions trying to crack this code, go beyond steps/calories/HR sensor data and generate insights.

For example, the iQ Group Global, an Australian consortium of life science and financial services companies, developed a biosensor capable of accurately measuring glucose in a person’s saliva. They claim that they built the world’s first non-invasive, saliva-based glucose test for diabetes management that measures glucose in saliva rather than blood. The saliva-based glucose test is being developed. The technology, invented by Professor Paul Dastoor and his team at the Centre of Organic Electronics at the University of Newcastle in Australia, comprises the Glucose Biosensor Unit and a digital healthcare app. The iQ Group Global acquired the biosensor technology in 2016 and has accelerated its development for diagnostic applications. The Glucose Biosensor Unit is a small, disposable strip, which when exposed to an individual’s saliva instantly provides a glucose measurement. The glucose measurement will be presented in real-time, via a proprietary digital app on a patient’s smart device.

Now some of you might be thinking “This is great but this looks more like a research project than an actual commercial product”. That’s a fair point but we believe this is the kind of technologies that will emerge in the coming years.

Picture: Glucose biosensor (iQ Group Global)

Another company focusing on glucose measurement in a non invasive way is Biolinq, which has raised $118M+ in funding. Of note this startup is backed by Dallas Mavericks (NBA) owner Mark Cuban. Biolinq is developing a device for patients with diabetes who regularly monitor the level of glucose in their blood. It uses sensors to test fluid in the uppermost layer of the skin. As shown in the picture below, the idea is that the patch, which the company describes as “pain-free,” would replace finger sticks and other more invasive monitoring methods.

Picture: Biolinq’s glucose monitoring solution.

We also believe that some of these new wearables, coupled with advanced AI and algorithms, will be able to detect heart attacks. In fact, Google created an artificial intelligence software capable of calculating a user’s risk factors for heart disease.

According to a study recently published in the Nature Biomedical Engineering journal, an AI algorithm created by Google AI and Verily Life Sciences (an Alphabet subsidiary that spun off from Google) can predict whether a patient is likely to suffer a major cardiovascular event like a heart attack or stroke within five years, based on a photo of their retina. So far, the predictions work about as well as presently accepted methods that are more invasive, according to the study. To mimic that ability, the Verily and Google researchers trained AI software to identify cardiovascular risks by having the system analyze retina photos and health data from 284,335 patients. Specifically, it looked at retinal fundus images, photos that show blood vessels in the eye.

Known risk factors for cardiovascular disease include age, blood pressure, and gender, among other things. Based on an eye scan, the algorithm was able to predict a person’s age to within 3.26 years, smoking status with 71% accuracy, and blood pressure within 11 units of the upper number reported in their measurement. A system has been developed by Google that can see the risks of cardiovascular disease through the eye.

3.Wearables, coupled with advanced and more accurate injury prevention software, set to become a key competitive advantage for pro teams.

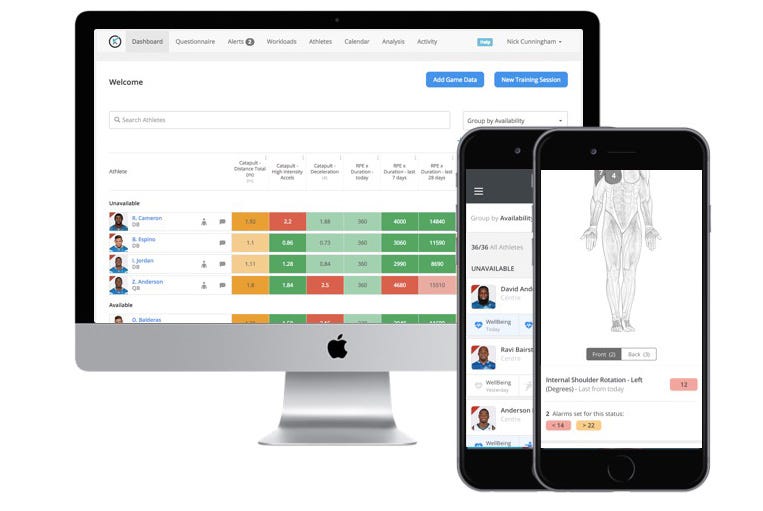

⬆️ The Upside: As we mentioned before, this is where advanced algorithms play a key role there as it has the ability to take a large amount of data and makes sense of it to generate meaningful insights. With that in mind, today we’re seeing many startups that are leveraging those types of algorithms to analyze a large amount of data (like wearable sensor data and video) in order to assess the risk factors of injuries, evaluate and even scout players. This is the case of some AMS vendors. The key there is for the system and the algorithms to understand the baseline for each player and flag potential risk of injuries for each players. That’s where some AMS software fall short and some other AMS vendors stand out from the crowd. You can read our full analysis of the AMS ecosystem market here. You can also check out our injury risk assessment tool analysis market (EMG sensors, AI based software, biomarkers, etc..) here.

Photo: Kitman Labs’ AMS system.

We believe that over time these various types of injury prevention and training systems using advanced algorithms or AI, coupled with advanced wearable devices, will become better at predicting the risk of injuries as new types of wearable biometric data (electrolyte, lactic acid, sweat volume, glucose, protein) become widely available and continue to feed the system. These new types of biomarkers will make the algorithms more capable and insightful over time.

4.New types of wearables capable of measuring human power, electrolyte, lactic acid, set to become a must have among pro teams.

⬆️ The Upside: This brings the next point which is the emergence of new biosensors capable of measuring new types of data. We talked about new sensors capable of measuring glucose level, but we are also seeing other companies developing biosensors to measure other markers for optimizing health and fitness. One of those companies is FLOWBIO, which is developing the world’s first real-time sweat sensing platform. Their product, the FLOWPATCH is unlocking the next generation of human performance data starting with total body fluid and electrolyte loss. The FLOWPATCH consists of a single-use sensor (to ensure maximum accuracy of data) and reusable electronics, which analyses the signals coming from the sensors and processes + streams the data and hydration recommendations to a smart-watch, bike computer or phone.

Picture: FLOWPATCH prototype.

Here is a video demo of the product in the field.

We believe that FLOWBIO has built one of the best sensing products out there. We like the form factor (smart patch) and the fact that it can measure body fluid and electrolyte loss in real time when the athlete is working out. But more importantly it can understand the baseline of each individuals. We also like the fact that it can recommend to athlete how much water he/she should drink.

5. New sleep tech form factors (smart wristbands..) capable of making athletes sleep, set to grow in popularity in 2022.

⬆️ The Upside: In 2022 we will also see new form factors such as bracelets capable of making athletes fall asleep. A leading player in this space is Remedee Labs a French startup that built a bracelet and solution capable of stimulating brain endorphin release, the body natural pain killer. The bracelet also helps increase sleep quality and decrease stress. Of note, Remedee Labs raised $12M to date. The bracelet is already being used by patients in hospitals in France.

Picture: Remedee Labs bracelet and app.

You can watch the video below to see how the Remedee Labs bracelet works.

Video: Remedee Labs, 2021.

We expect to see these types of new sleep tech form factors emerging in 2022 which will help teams improve athletes’ sleep, reduce stress and ultimately improve athletes’ performance.

6. New AR form factors (AR contact lenses..) will start to emerge in 2022 and beyond.

⬆️ The Upside: 2022 will also see the emergence of new AR form factors such as AR contact lenses. For example Mojo Vision, a well funded SF based startup, is building the world’s first AR contact lenses. Granted we think we are probably still 2 years away before we see AR contact lenses for the masses. Also, not every one will want to wear AR contact lenses as only 22% of Americans wear contacts, according to the Vision Impact Institute research. But we believe that there is a niche market for AR contact lenses for sports like cycling, running, tennis, golf and so on. Mojo Vision has made great progress. It is also worth pointing out that Nike recently invested $45M into Mojo Vision.

Here is below an actual picture of the Mojo Vision’s AR contact lenses:

Picture: Mojo Vision’s AR contact lenses, 2022.

Here is what the AR overlay looks like by looking through the AR contact lenses:

Picture: Mojo Vision’s AR contact lenses, 2022.

You can check out our podcast interview with Dave Hobbs Director of product management at Mojo Vision where he speaks about Mojo Vision, his vision of the market, the sports use cases, and so on. You can click here to listen to our Upside podcast interview with Mojo Vision.

Video: Mojo Vision video, 2022.

Here is a video showing the actual Mojo Vision AR contact lenses:

Bottom line: The future of wearable sports devices is bright. We expect to see the emergence of a new generation of wearable devices capable of measuring biometric data (Sleep quality, falls, HR, stress level, blood pressure..) without any contact to the skin, detecting early signs of chronic diseases (e.g. diabetes..), and predicting with a high level of accuracy the risk of injury for specific athletes. On top of that, those wearable devices will use more advanced algorithms which will help those wearables provide more meaningful insights. Lastly we expect to see the emergence of new type of biosensors capable of measuring new types of data such as blood pressure, lactate, hydration, electrolyte, in the coming years. The level of accurate of those wearables is also expected to improve over time. On the AR side of things, we expect to see the emergence of hybrid AR/VR contact lenses capable of switching from a “virtual” to an “augmented” environment. Users will be able to get metadata (HR, distance ran, speed..) with performance insights through those AR contact lenses. All this will help make those wearables more insightful and even save more human lives.

Leave A Comment

You must be logged in to post a comment.