Over the past 12 months there has been a lot of hype about the NFT Sports market with many sports teams, leagues (NBA, AS Roma..), athletes (Tom Brady, Osaka, Tiger Woods..), and major tech funds (Andreessen Horowitz) getting into the space. This brings the following questions: Is the NFT Sports market real? Is it a fad? Where is the market heading? In this analysis, we will go over those questions and discuss where we believe the market is heading. Lastly, we will provide recommendations to any pro teams and leagues looking to get into the NFT Sports market.

What are NFTs?

Many of the teams that we work with have asked us: What exactly are NFTs? To put things simply, NFTs, also known as a non-fungible token (NFT) is a unit of data stored on a digital ledger, called a blockchain, that certifies a digital asset to be unique and therefore not interchangeable. NFTs can be used to represent items such as photos, videos, audio, and other types of digital files. Put simply, NFTs are essentially digital certificates, secured with blockchain technology, that authenticate an item’s provenance, that it is a limited edition or one of kind, and enable it to be bought and sold as such.

As a fan you want to get a certified video copy of Roger Federer’s winning shot at the US open tennis and be able to sell it to others and make money along the way? This is what NFTs are for.

More athletes, teams, leagues, getting into the space every week

Literally every week we are seeing major sports teams, leagues or athletes entering the NFT Sports market. We have seen a similar phenomenon when 24 months ago literally every athlete and teams were getting into the esports market as investors, or endorsers.

Some leagues such as the NBA have been early adopters of NFTs with the launch of NBA’s Top Shots. So far it has paid off with NBA’s Top Shot sales accounting for $500M in transactions in the first 3 months of 2021. Just to put things into perspective this represented a third of the $1.5B in NFT transactions, according to DappRadar, a Blockchain market research firm. This compares to a total value of $250M in NFT transactions in 2020, according to data from Nonfungible.com.

Today there are more than 3 million NFTs for sale, and sales volume on the top sources has grown over 400x year over year to more than $100 million per week.

Picture: NBA’s Top Shot

Pro teams are also getting into the space. Last April, the Warriors (NBA) made history by becoming the first US professional sports team to issue its own NFT collection, which includes limited-edition digital versions of championship rings and ticket stubs.

Picture: Warriors (NBA)’s NFT collection

In the world of pro soccer, last week, AS Roma, a top Italian soccer team, announced a $42M, 3-year exclusive partnership with blockchain fintech Zytara Labs. According to Coindesk, this partnership probably represents the most notable sponsorship deal between a soccer club and blockchain firm to date.

The Chicago Bulls also launched a championship series commemorating their legendary team from the 90s. That itself is nothing special yet, as “legacy collection” have become fairly common. The interesting angle though is their partnership with ecommerce giant Shopify who recently integrated the NFT platform Sweet into their offering.

Pictures: Chicago Bulls’ NFT collections

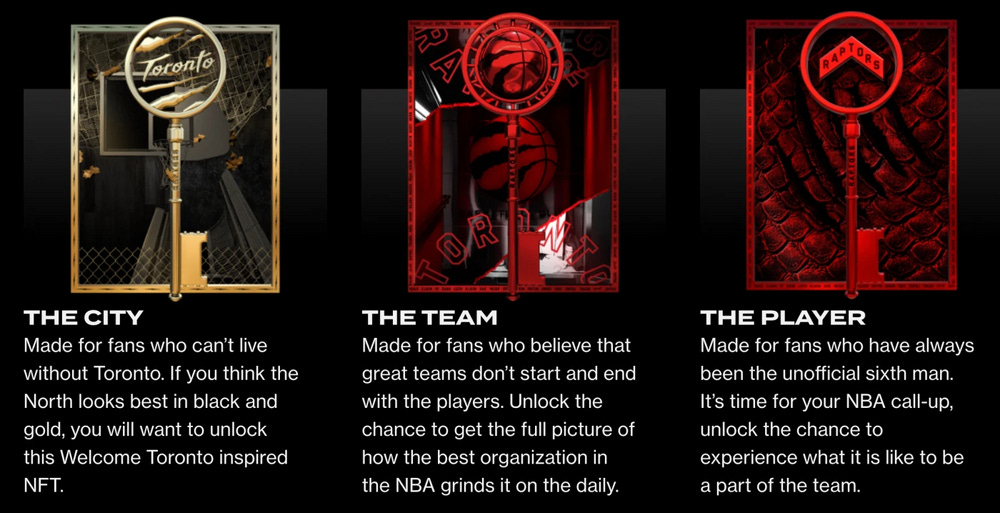

The Toronto Raptors also followed suit by launching their first official team NFT. The collection features six different areas, so-called “keys”, that represent different aspects of the organization.

Picture: Raptors’ NFT collections

In addition, the NBA G League announced their inaugural NFT collection.

The Olympics just ended and of course it was inevitable that the NFT craze entered the Olympic world with the International Olympic Committee (IOC) launching an official NFT marketplace for fans to collect Olympic memorabilia digitally. Britain’s Team GB also launched its own NFT marketplace.

Lastly, not surprisingly, some of the world’s most recognizable athletes, are also entering the space, selling their own branded NFT items. For example, NFL quarterback Patrick Mahomes is now selling signed digital artwork. Champion skateboarder Mariah Duran and paralympian Scout Bassett were also among a group of elite women athletes to release NFTs three months ago. But the most notable athlete getting into NFT is probably NFL legend Tom Brady who co-founded Autograph, an NFT platform that “leverages official licensing of prominent athletes and celebrities to provide a wide array of digital collectibles.” Brady already unveiled multi-year exclusive NFT deals with “founding partners” including Tiger Woods, Wayne Gretzky, Derek Jeter, Naomi Osaka and Tony Hawk. Brady also announced strategic partnerships with Draftkings and Lionsgate. In a separate endeavor, Peyton and Eli Manning launched last April The Manning Legacy Collection, a set of digital tokens that was auctioned on MakersPlace. Sales of the NFTs benefited the Peyton Manning Children’s Hospital at Ascension St. Vincent in Indianapolis and Tackle Kids Cancer. Other athletes like NHL’s biggest stars, Alexander Ovechkin, also launched their own NFT collections. The point here is that those world’s class athletes are seeing the writing on the wall, they see all the attention that NFT is getting, they have millions of followers, and they want to bank on the opportunity by launching their own NFT collections. We expect many more athletes, teams, leagues, to follow suit.

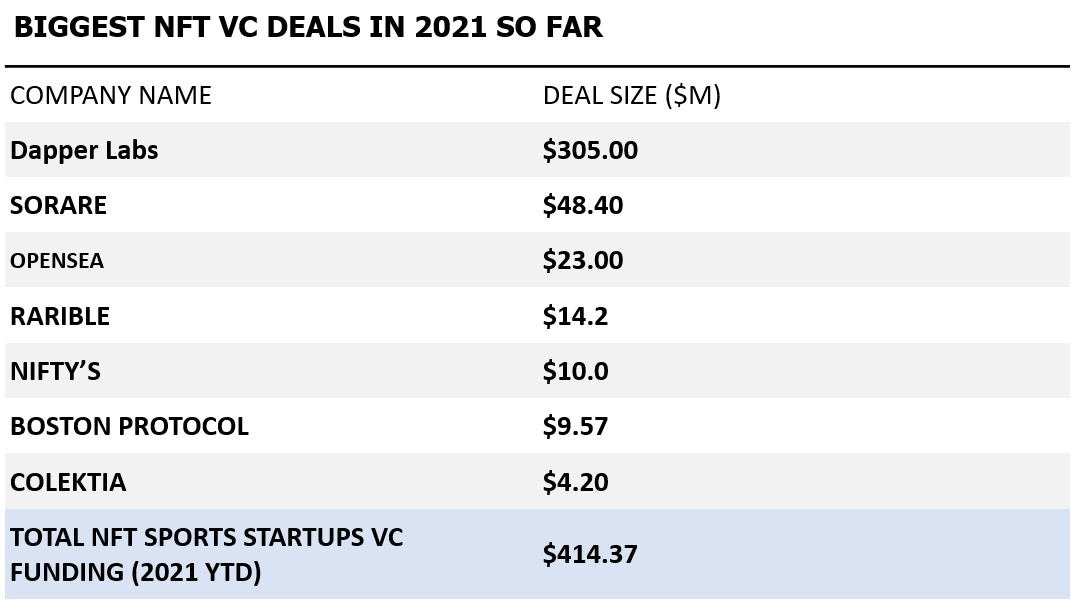

VCs also betting on NFT startups. +10 times more VC money invested in NFT so far in 2021 Vs 2020.

As shown in the tablet below, $414M has so far been invested by VCs into NFT startups in 2021. That’s more than x10 times the $35M that NFT start-ups raised in 2020.

The largest NFT startup deal ($305M) was for Dapper Labs, the maker of NBA’s Top Shot. The second largest one was Sorare, a blockchain-based fantasy football game, which $50M in February from VC heavyweights like Benchmark and Accel, as well as soccer star Rio Ferdinand. You can listen to our podcast interview with the head of Sorare’s licensing here. But so far this year we have seen some other notable NFT startups raising money, such as Open Sea ($23M), Rarible ($14M), Nifty’s ($10M), Just to name a few. Of note, just a few weeks after Dapper Labs raised $305M at a valuation of $2.6 billion, the company announced that it was raising a new round at a valuation above $7.5B, according to a person with direct knowledge of the deal talks.

“It’s one of the most exciting developments we’ve seen in crypto for years,” Andrei Brasoveanu, a general partner at Accel, told CNBC. “It’s one of those developments that has mass market appeal and could potentially impact a world outside the crypto niche.”

Source: Upside Global, 2021

One of the most actives VCs in the NFT space is Andreessen Horowitz which invested into Open Sea and Dapper Labs, and launched a $100M NFT fund dedicated to NFT startups. True Capital Management, which invested into Dapper Labs, is another active VC in the NFT space. Accel, which invested into Sorare, is another top NFT investors out there. On the sports ownership side of things, it is not surprising to see Dallas Maverick’s owner Mark Cuban, among the top NFT investors. Mark Cuban invested in NFT startups such as Nifty’s. In the next 24 months, we expect to see more top VCs, athletes, and pro teams, to jump on the NFT bandwagon.

Risks with NFT startups: From high environmental impact to no business models. M&As likely to accelerate.

There are two main risks when it comes to investing into NFT sports startups. The first one is related to the environmental impact. Granted, not everyone cares about protecting the environment but we think it is an important manner.

Put simply, creating NFTs, because of the energy used in blockchain verification processes, can have an impact on the environment. According to some experts, making and transporting physical goods has a range of environmental impacts, but by one calculation the carbon footprint of selling an NFT artwork is almost 100 times that of selling and transporting a print version. Last February, French digital artist Joanie Lemercier cancelled the sale of six works, and urged others to do the same, after calculating those sales would use the same amount of electricity in ten seconds as his studio used in two years. Therefore, it will be critical for NFT vendors to focus their efforts on adopting blockchain mechanisms that are more energy efficient and environmentally friendly.

Then of course, like with new emerging technologies, there is a lot of hype around the NFT sports market. Many of the clubs we work with told us that they are faced with many NFT Sports startups that do not have solid business models and even in some cases have no business model at all. In our opinion, that needs to change dramatically.

So what’s the problem here? We believe that some startup founders entered the NFT sports market but without true knowledge of how blockchain works. Some of them are not business savvy. They are just opportunistic and hoping to surf the NFT wave. Now because of that we expect to see M&As in the NFT sports market accelerate in the next 24 months with some NFT sports vendors getting bought by bigger players, and other NFT vendors shutting down due to the lack of traction or solid business model. Which brings the next question: When will the NFT Sports bubble burst? We believe it is only a matter of time but the good news is that only the strong players will survive which will be good news for the NFT sports market as a whole.

NFT, new vehicle enabling clubs to attract and fully monetize Gen Z?

Currently, one of the biggest challenges fased by sports organizations is based on one main question: How to attract the young generation (Gen Z) which are gravitating away from sports and spending a large amount of time on free new media such as TikTok? This is why many sports organizations are looking for new ways and revenue streams targeting the Gen Z.

This is where NFTs come in as it enables clubs to attract and monetize the young generation. Put it another way, nowadays we are seeing many teenagers earning money via cryptocurrency. NFTs enables young fans to earn money by trading their NFTs of their favorite players.

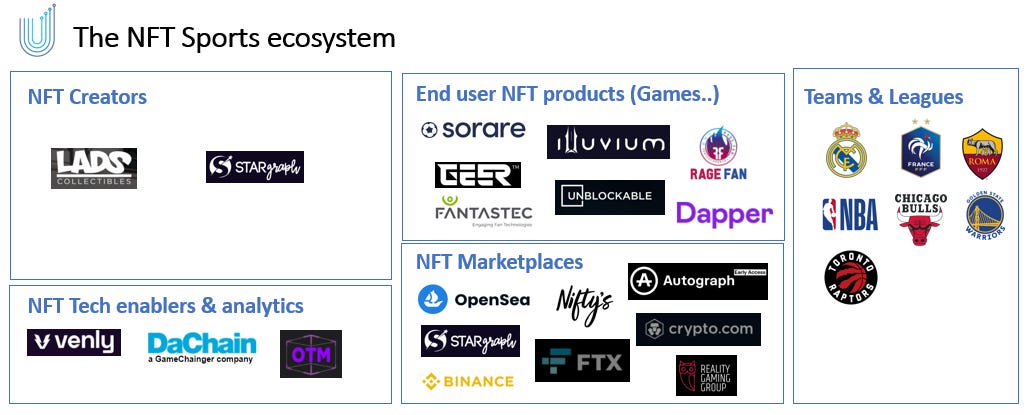

NFT Sports vendors ecosystem: From NFT creators to NFT marketplaces

The NFT sports market is comprised of various subsegments that can be summarized as follow:

- NFT creators: Typically NFT creators are companies that enable sports organizations (clubs, leagues..) to offer and sell their own NFTs to their fans. Those include companies such as MyLads, STARGraph, just to name a few.

- End users NFT product vendors (e.g. Games): These are NFT vendors who offer sports organizations an NFT platform which enable them to create end user NFT products (e.g. games, etc.) and sell their own NFTs (e.g. players trading cards..) to their fans. Those include companies such as Sorare, Geer, Fantastec, Illuvium, Rage Fan, Dapper Labs, Unblockable.

- NFT marketplaces: Typically NFT market places vendors enable teams, athletes to sell their NFTs to their fans. Those include companies such as Crypto.com, Binance, FTX, Autograph, Open Sea, Reality Gaming Group, STARgraph, or Venly.

- NFT Tech enablers & analytics companies: These are companies who typically provide the tools to NFT creators to create NFTs for their customers (clubs, agencies..). Simply put these are technology enablers for NFT creators. The types of tools that these company usually offer are blockchain wallets, NFT management/creation solutions, NFT marketplace, and/or NFT API with deep analytics. Companies such as Venly or Dachain.io are among the top vendors in this NFT segment. Other companies such as OTM offers deep analytics and consulting services as well.

Source: Upside Global, 2021.

In this next section, we will highlight some of the major NFT vendors in the market. Please note that this list of vendors is not meant to be all inclusive.

1.MyLADS

Founded: 2020

HQ: Lisbon (Portugal)

Amount money raised: $8.98M

Website:MyLADS® – Sports Teams Official Figurines with Augmented Reality

Investors: Albuquerque & Associates, Antonio Felix da Costa, The Riva Group

Total employees: 17

MyLads is an NFT vendor which enables sports organizations to create and sell sports collectibles of their players using Augmented Reality. For example, fans can take virtual AR based pictures and videos with their favorite players. Fans can also virtually visit stadiums and play games and win prizes.

2. STARgraph:

Founded: 2017

HQ: Rome (Italy)

Amount money raised: Raised $250k; Raising $7.5M.

Website: nft.stargraph.it

Investors: Angels

Total employees: 15

Customers / partners: 10 customers (athletes, clubs, federation, agencies, photographers)

STARgraph is an NFTs marketplace, with fans gamification and tokenomics to reverse the paradigm, going from “fans monetization” to “fans that monetize their passion”.

STARgraph is a platform that allows the fans to monetize their passion buying and holding their NFTs. It also allows the Sports industry to monetize their new or existing digital assets. Typically STARgraph receives a 30% revenue cut from customers (clubs..) on each NFT sold (collectibles…) through its marketplace. Fans who buy a STARgraph NFT will receive STARgraph Fungible Tokens for just holding their assets into the wallet: when a major event happens (i.e. player won a championship), the fan will receive an important amount of tokens.

STARgraph goals for the next 24 months is to secure new investment, execute on its product roadmap, and create an NFT wallet capable of working with every blockchain out there.

STARgraph’s main goal is to help sports organizations transition from a fan monetization model to a virtuous model in which fans monetize their passion. They also aim at helping sports organizations use NFTs as a new vehicle to better engage with the new younger generations of fans (e.g. Gen Z). Lastly, STARgraph also offers an NFT solution that is environmentally friendly.

3. Sorare

Founded: 2018

HQ: Paris (France)

Amount money raised: $59.25M

Website: https://www.sorare.com

Investors: Accel, Alexis Ohanian, Benchmark, Gary Vaynerchuck, Gerard Pique, Antoine Griezmann.

Total employees: 32

Customers / partners: 140 soccer clubs (Real Madrid, Liverpool, PSG, Boca Juniors, River Plate, etc.)

Founded in 2018, Sorare was created by football fans for football fans. Through blockchain digital collectibles and its global fantasy football, the company is on a mission to become ‘the game within the game’.

Sorare is transforming online sports fandom and giving its community a new way to connect to the clubs and players that they love. Fans can buy, sell, trade NFTs or digital player cards. The platform had a card sales volume of over $80M since January 2021 across 150 countries. More than 150 professional clubs have partnered with Sorare. Sorare’s business model is based on licensing and partnerships and depending on the scope of the cooperation, the licensors get different benefits to be part of Sorare. Sorare essentially pays royalties both on the primary and secondary markets. Sorare’s audience is international and diversified. Geographically, about 20% of Sorare’s users are located in the US, another 20% are in Asia and the remaining 60% are in Europe and the rest of the world. As of December 2020, Sorare sold $1.8M worth of cards. Based in Paris, Sorare is funded by a world-class team including Softbank, Benchmark, Headline, and footballers Gerard Piqué, Antoine Griezmann and Rio Ferdinand.

Sorare’s plans for the next 12-24 months are more or less the following. First, they want to accelerate the hiring process. The second is to continue to onboard the top clubs and also the top 20 soccer leagues in the world. Lastly, they want to continue to sign deals with national teams and are looking to develop a mobile application.

4. Autograph:

Founded: 2021

HQ: Los Angeles (USA)

Amount money raised: TBD

Website: www.autograph.io

Investors: Tom Brady, Tiger Woods, Naomi Osaka, Wayne Gretzky, Derek Jeter

Total employees: 27

Customers / partners: DraftKings, Lionsgate, Wayne Gretzky, Derek Jeter, Naomi Osaka and Tony Hawk.

Co-founded by Tom Brady and headquartered in Los Angeles, Autograph is an NFT platform that brings together iconic brands and legendary names in sports, entertainment and culture to create unique digital collections and experiences.

5. Illuvium

Founded: 2020

HQ: Sydney (Australia)

Amount money raised: $5M

Website: www.illuvium.io

Investors: Framework Ventures, IOSG Venture

Total employees: 31

Illuvium makes a game that rewards players with the opportunity to explore and capture NFT creatures, known as Illuvials, in combat.

6.Rage Fan

Founded: 2021

HQ: Virgin Islands

Amount money raised: $1.6M

Website: rage.fan

Investors: AU21 Capital, Genesis Block Venture, Spark Digital Capital, Moonwhale Ventures.

Total employees: 6

Rage.Fan is an on-chain fantasy & utility NFT (uNFT) sports platform built on Blockchain Technology.

7. Geer

Founded: 2017

HQ: San Francisco, CA

Amount money raised: $1M

Website: https://www.geer.it

Investors: 2

Total employees: 21

Geer built a premier NFTs platform for blue-chip brands. Since 2017, they have enabled premium brands to achieve increased revenue streams and consumer engagement by monetizing their digital identity through NFTs sold both as authentic collectibles and in-game items (i.e., skins).

8. Unblockable

Founded: 2018

HQ: Manhattan Beach, CA

Amount money raised: $5M

Website: www.unblockable.com

Investors: Shasta Ventures and Lightspeed Venture Partners.

Unblockable empowers sports fans to buy, sell, and use blockchain based digital collectibles of individual athletes.

9. Fantastec

Founded: 2017

HQ: Guildford (UK)

Amount money raised: $830k

Website: https://www.swap-fantastec.com/

Total employees: 18

Customers / partners: Dapper Labs, Real Madrid, Arsenal FC.

Officially launched in 2018, Fantastec has successfully minted a vast array of highly unique NFTs, ranging from Gareth Bale’s UEFA Champions League-winning bicycle kick for Real Madrid in 2018, to Erling Haaland’s signature from his first season at Borussia Dortmund.

In June 2021, Fantastec SWAP inked a partnership deal with Dapper Labs to launch a peer-to-peer non-fungible token (NFT) marketplace that put highly unique crypto-collectibles of leading football clubs including Real Madrid, Arsenal, and Borussia Dortmund on Dapper Labs’ Flow blockchain.

10. Reality Gaming Group Limited

Founded: 2017

HQ: London (UK)

Amount money raised: Public company ($2.5M ICO)

Website: http://www.realitygaminggroup.com

Investors: TBD

Total employees: 19

Customers / partners: Mayweather

Reality Gaming Group develops innovative games and marketplaces that combine the best of traditional gaming with new technology based on the blockchain. The company also offers NFT based trading card games, Doctor Who: Worlds Apart and mobile AR shooter, Reality Clash.

11.Dapper Labs

Founded: 2018

HQ: Vancouver (Canada)

Amount money raised: $357.7M

Website: www.dapperlabs.com

Investors: Dapper Labs is funded by 88 investors. True Capital Management and Andre Drummond are the most recent investors.

Total employees: 100-250

Customers / partners: NBA (Top Shot)

Dapper Labs is a consumer-focused Flow blockchain product made for fun and games and supports digital collectibles. Dapper Labs builds products tailored to the user and ensures that items of value to you are decentralized.

12. Venly

HQ: Antwerp (Belgium)

Amount money raised: $2M

Website: www.venly.io

Investors: High-Tech Gründerfonds (HTGF), Tioga Capital, DM-BB David Majert, Palentine Ventures (Blockrocket), imec.istart Fund.

Total employees: 10

Customers / partners: Sandbox, Vulcan forged, Polygon, Avalanche, Hedera Hashgraph, Binance Smart Chain.

Venly offers tools to NFT creators to create NFTs for their customers (clubs, agencies..). Simply put it is a technology enabler for NFT creators. Venly’s competitive advantage is based on the fact that it can offer a full round NFT solution for NFT vendors such as a blockchain wallet, an NFT management/creation solution, an NFT marketplace, and NFT API with deep analytics.

13. Dachain.io

Founded: 2021

HQ: London

Amount money raised: 2.5M Euros

Website: dachain.io

Investors: Marco Corradino, Aser Ventures.

Total employees: 5

Customers / partners: 3

Dachain.io’s platform consists of a scalable, decentralized, cross-chain network designed to bring non‑fungible tokens (NFTs) to everyone. Users can interact with their platform as a service (Saas) through an API or via a customized front-end. They offer a series of tools that allow them to implement customized solutions for each type of market and business model.

Dachain.io’s business model is based on a Saas model to use their platform through API or Whitelabel.

Dachain.io’s goals for the next 24 months is to deliver 3 projects they have in their pipe in the sports, music and luxury sector.

Dachain.io’s competitive advantages can be summarized as follow:

- They combine the best of Ethereum with an easy multi-chain system.

- Highly customizable and upgradable reducing time-to-market for you project

- Zero blockchain experience required

- Zero Gas Fee

- Developer support

- Multi payment system integration for a large variety of monetization

- Built-in compliance system

- Innovative Beam QR code technology to leverage off chain transactions

- Experiment with selling digital content on a blockchain with ease

14. Open Sea:

Founded: 2017

HQ: New York

Amount money raised: $127.2M

Website: https://opensea.io

Investors: Andreessen Horowitz, Alexis Ohanian, Blockchain Capital.

Total employees: 42

OpenSea provides the link between the consumer layer and the infrastructure layer for the digital goods economy and is a key utility in this new world of digital ownership. OpenSea provides a one-stop shop to discover, buy, and sell any non-fungible digital asset that conforms to a popular standard like ERC721, and it also quickly tells users the “who, what, when, where” about a particular NFT. OpenSea shows users the provenance, trading, and sales history of digital items in a readable, trusted way.

Given the importance of this consumer layer in such a fast-growing area, it’s no surprise that OpenSea’s growth has been off the charts, with transaction volume growing 100x in the last six months.

OpenSea Daily Volume

Source: Dune Analytics

15. Nifty’s:

Founded: 2021

HQ: Miami (USA)

Amount money raised: $10M

Website: https://www.niftys.com

Investors: Mark Cuban, Joseph Lubin, founder and CEO of ConsenSys and co-founder of Ethereum, 0xb1, Draper Dragon, Tally Capital, Liberty City Ventures, and Future Positive which is led by Biz Stone, Fred Blackford, co-founder of Swing Technologies. A&T Capital, Polychain Capital, Ethereal Ventures, Liberty City Ventures, Dapper Labs, Topps, Polaroid, and Samsung Next.

Total employees: 27

Customers / partners: Warner Bros, Space Jam.

Nifty’s, Inc., based in Miami, is the first NFT-focused social media platform that brings together premium publishers, brands and creators with collectors, curators and the communities of fans that will emerge around them. Offering an easy-to-use interface, the innovative platform allows members to create, collect, discover, and curate the most important digital art and other collectables from across the scattered NFT universe. Leveraging MEME Protocol’s technology, Nifty’s provides creators with a premium, flexible and safe platform to launch their NFTs.

Recently Nifty’s teamed up with Warner Bros to launch a single limited-edition NFT to anyone who registers on Nifty’s and also visits the Space Jam NFT collection page. The NFTs featured the Los Angeles Lakers’ James and the Looney Tunes’ “Tune Squad.” The Space Jam: A New Legacy NFTs were produced by Palm NFT Studio which uses advanced blockchain tech that claims to reduce “energy consumption by 99%.”

16. Own The Moment (OTM)

Founded: 2021

HQ: Fully remote

Amount money raised: $500,000

Website: https://otmnft.com

Investors: Techstars, Dapper Labs, Establish the Run, and others

Total employees: 6

Customers / partners: Detroit Pistons, ASICS, Underdog Fantasy

Own the Moment (OTM) is a premium subscription service that helps collectors invest in the fast-growing world of NFTs. OTM provides content and community via a web platform with data and analysis on how the NFT market is performing, a podcast/YouTube channel that provides additional insights, and 20k+ followers on Twitter and 2k+ power users in Discord that are actively engaged in collecting NFTs. In addition, OTM’s Consulting Services works with leading brands such as ASICS and the Detroit Pistons to develop and launch their NFT projects.

Founded by experts in Blockchain and Sports Analytics and backed by strategic investors including Dapper Labs (NBA Top Shot), OTM is currently in the Techstars Sports Accelerator and gearing up for a $1M seed round post demo day. Understanding NFTs is hard, OTM is here to provide the tools and services necessary to support the community in adopting this emerging technology. Own the Moment is building the “Bloomberg for NFTs.”

OTM’s business model is based on a B2C: subscription service B2B: affiliate model and consulting services.

OTM’s goals for the next 24 months is to launch a premium subscription service and expand their product to include deep dive analysis for NFTs beyond NBA Top Shot.

17. Crypto.com

Founded: 2016

HQ: Hong Kong

Amount money raised: $200M (ICO)

Website: www.crypto.com/

Total employees: 500-1000

Crypto.com is a payment and cryptocurrency platform that empowers users to buy, sell, and pay with crypto.

The platform enables users to control their money, data, and identity. It serves over 10 million customers, with the growing crypto app, along with the Crypto.com Visa Card, a crypto card, the Crypto.com Exchange, and Crypto.com DeFi Wallet.It also offers a powerful alternative to traditional financial services.

Crypto.com was founded in 2016 by Bobby Bao, Gary Or, Kris Marszalek, and Rafael Melo in Sai Wan, Hong Kong Island, Hong Kong.

18. FTX

Founded: 2018

HQ: San Francisco, CA

Amount money raised: $908M

Website: ftx.com/

Investors: FTX is funded by 29 investors. Coinbase Ventures and Sequoia Capital are the most recent investors. NEA, Lightspeed Venture, and Softbank are other key investors.

Total employees: 50-100

FTX is a cryptocurrency derivatives exchange built by traders, for traders. They strive to build a platform powerful enough for professional trading firms and intuitive enough for first-time users. FTX supports quarterly and perpetual futures for all major cryptocurrencies, leveraged tokens, and OTC.

FTX was incubated by Alameda Research, a top cryptocurrency liquidity provider. Because of this FTX has had industry-leading order books from day one. FTX was co-founded by Sam Bankman-Fried and Gary Wang, in 2018. Their mission is to build the best derivatives exchange and to help move this space toward becoming institutional.

19. Binance

Founded: 2017

HQ: Valletta, NA – Malta, Malta

Amount money raised: $35M (ICO)

Website: www.binance.com

Investors: Binance is funded by 13 investors. Karnika Yashwant and Vertex Ventures Southeast Asia & India are the most recent investors. Binance has raised a total of $1B across 3 funds, their latest being Secure Asset Fund For Users (SAFU).

Total employees: 250-500

Binance is a cryptocurrency exchange platform that combines digital technology and finance. The company provides access to exchange digital currency pairs on the market while maintaining security, liquidity, enabling a safe and efficient deal with anyone, anytime and anywhere.

Recommendations to pro teams and leagues looking to get into the NFT Sports market.

- Create purposeful / valuable NFTs that will remain valuable over time. Some experts argue that during the early days during the hype phase a lot of NFTs got sold but those actually had no value. With that in mind, it is important for sports organizations to think about using NFTs for community building where it would allow users to access to vote on certain decisions, or give them access to unlockable content, or additional perks when playing a game.

- Focus on usability and user experience. Your NFTs should not only be for the crypto natives. The point here is that it is important to offer NFT solutions with a great user experience:

“Vulcan Forged uses Venly’s white labelled wallets, which means that people can sign up to their game with email/password. Then they can start playing the game and collect NFTs. Here the users do not need blockchain knowledge. With the Logan Paul NFT sale, we sold the NFTs through a Shopify store where people could buy them with a credit card. They received a mail in their inbox with a sign up link to Venly to sign up and claim there wallet. By doing so, you can reach a mainstream audience. Just like you don’t need to know TCP/IP to send an email you shouldn’t know anything about blockchain to own an NFT or play a blockchain based game”, said Gerbert Vandenberghe, CEO of Venly, during an interview with The Upside.

- Be informed on the blockchain technology, its pros and cons and the ecosystems of the different blockchains. It is also important for sports organizations to fully understand blockchain technologies as well as its pros and cons. They differ in terms of speed, transaction costs and security. Some have a large engaged community and others fake their traction.

- Use good development partners and development tools. Sports organizations do not need to be a blockchain expert to create NFT applications with the existing tooling. Companies like Venly or Dachain.io provide these tools, which makes it easy to develop user-friendly NFT apps and experiences. Leveraging these tools can save sports organizations a lot of time, effort and money building their NFT apps over time.

- Design your NFTs with marketplaces and wallets in mind. It goes back to offering NFT solutions with the best user experience. In this case, making marketplaces and wallets key components of the NFT buying experience should be top of mind for any teams looking to launch an NFT solution. This is where working with companies like Venly or Dachain.io to offer a white label wallet and market place is critical.

- Respect the NFT standards. There are mainly two standards: ERC-721 and ERC-1155. Respecting these standards will make sports organizations NFTs usable in all wallets and NFT markets.

- The Metaverse: Partnerships with other NFT projects can bring extra value to your NFTs. Like with any new markets, join forces with other players in the ecosystem is key. The same applies to the NFT space. Any sports organizations looking to build an NFT solution should try to team up with other NFT companies in order to offer extra value and leverage the expertise, solution and know how of other NFT players.

- Understand that royalties are not automatically enforced by the smart contract.

“The smart contract doesn’t know the price for which an item is traded on a marketplace so it cannot enforce the payment of royalties. It is the different marketplaces that process the royalties. You have to make sure they pay you out your royalties, it is not something that happens automatically after you deployed your contract. There are however standards coming that might make it more transparent, though you will always depend on the marketplaces”, explains Gerbert Vandenberghe, CEO of Venly, during an interview with The Upside. - Leverage NFTs owners’e email addresses for direct marketing purposes: Sports organizations should leverage NFT owners’ email addresses in order to create a new channel for direct marketing purposes and create a direct relationships with the fans.

“If an NFT solution is using a wallet, you can see all blockchain wallets that own an item from Dolce & Gabbana. Therefore, you can target the owners of these wallets by minting an NFT to their wallet, which will show up in their wallet. This can become an interesting marketing channel”, explains Gerbert Vandenberghe, CEO of Venly, during an interview with The Upside.

- Don’t forget legal. It is important for any sports organizations looking to launch an NFT solution to remember that all blockchain based assets are getting regulated. This is not only the case for cryptocurrencies. Therefore it it critical for sports organizations to consult with their legal department or legal experts in order to properly implement their NFT solution.

- Consider the environmental impact of the NFT solution: As we pointed out earlier, creating NFTs, because of the energy used in blockchain verification processes, can have an impact on the environment. This is why it is important to pick NFT solutions or work with NFT vendors (e.g. STARgraph) focusing on mitigating the impact of NFT on the environment.

- Use NFTs as an engagement lever. It is also important for sports organizations to use NFTs as a way to increase fans engagement which will help unlock additional benefits (e.g. drive their top line..) over time.

- Do not base your decision to pick an NFT vendor only based on the NFT vendor’s guaranteed minimums: As a sports organization looking to pick an NFT vendor, picking a vendor primarily based on the guaranteed minimums alone provided by the NFT vendor, is unlikely to be a good strategy for sports organizations. Based on our sources, some NFT vendors are willing to pay sports organizations as much as $500k to secure deals. Instead, sports organizations should pick NFT vendors based on a variety of factors (e.g. environmental impact, business model, customer support..).

- Allocate a good portion of your budget for fans education and communication: Like any new technologies it is sometimes difficult for sports organizations to fully understand new technologies. In this particular case, sports organizations should allocate a good portion of their NFT budget to educate their fans on how to properly use NFTs. This could be done via a variety of ways such as webinars, white papers, educational videos, etc. The education part is critical here. It will help sports organizations successfully launch their NFT solutions.Bottom line: There is no question that the NFT Sports market is booming. Some experts believe that there is too much hype about the NFT Sports market right now. We would agree with that. In our view, like any new markets, there are some really solid NFT companies out there but there are also some NFT vendors without solid business models or no business models at all. The vast majority of the sports teams we talked to want to work with NFT vendors that have a solid business model in order for them to get the best ROI. When it comes to choosing their NFT sports vendors, sports organizations need to focus on building a full NFT solution (wallet, market place..) with a seamless user experience. They also need to focus on educating fans about NFTs to guarantee success and mass adoption. Ultimately we also expect to see M&As activities in the NFT space accelerate in 2021 and beyond.

Leave A Comment

You must be logged in to post a comment.