HR/HRV monitoring market: Key Players, Trends, Recommendations to Pro Teams

With less than 10 leading HR/HRV monitoring vendors (Polar, Firstbeat, Suunto, Whoop..) in the market today, aside from GPS systems, HR/HRV monitoring systems have become one of the most common technologies used by pro teams today. Similar to GPS systems, pro teams and leagues have to pick the right HR/HRV system that fits their requirements, use cases, budget, and requirements. In this analysis we will discuss the current and future market trends, VC/M&A investment trends, the HR/HRV vendor ecosystems, and the key HR/HRV vendors. We will also provide recommendations to pro teams looking to adopt a HR/HRV solution.

What are HR monitoring systems?

HR systems, also known as heart rate monitors (HRM), have been used by pro teams for a long time. They enable teams to track players’ heart rate. It is largely used to gather heart rate data while performing various types of physical exercise. Measuring electrical heart information is referred to as Electrocardiography (ECG or EKG).

Generally speaking, teams use HRM devices to determine whether the player is tired, or fit for their next game and could benefit from resting.

Of note, early models consisted of a monitoring box with a set of electrode leads which attached to the chest. The first wireless EKG heart rate monitor was invented in 1977 by Polar Electro as a training aid for the Finnish National Cross Country Ski team. As “intensity training” became a popular concept in athletic circles in the mid-80s, retail sales of wireless personal heart monitors started in 1983.

Modern heart rate monitors commonly use one of two different methods to record heart signals (electrical and optical). Both types of signals can provide the same basic heart rate data, using fully automated algorithms to measure heart rate, such as the Pan-Tompkins algorithm.

- ECG (Electrocardiography) sensors measure the bio-potential generated by electrical signals that control the expansion and contraction of heart chambers, typically implemented in medical devices.

- PPG (Photoplethysmography) sensors use a light-based technology to measure the blood volume controlled by the heart’s pumping action.

The electrical monitors consist of two elements: a monitor/transmitter, which is worn on a chest strap, and a receiver. When a heartbeat is detected a radio signal is transmitted, which the receiver uses to display/determine the current heart rate. This signal can be a simple radio pulse or a unique coded signal from the chest strap (such as Bluetooth, ANT, or other low-power radio links). Newer technology prevents one user’s receiver from using signals from other nearby transmitters (known as cross-talk interference) or eavesdropping. Note the older Polar 5.1 kHz radio transmission technology is usable underwater. Both Bluetooth and Ant+ use the 2.4 GHz radio band, which cannot send signals underwater.

What are HRV monitoring systems?

Generally speaking, Heart rate variability (HRV) is the physiological phenomenon of variation in the time interval between heartbeats. It is measured by the variation in the beat-to-beat interval.

Other terms used include: “cycle length variability”, “R–R variability” (where R is a point corresponding to the peak of the QRS complex of the ECG wave; and RR is the interval between successive Rs), and “heart period variability”. Teams typically use HRV monitors to assess players’ sleep quality, stress and fatigue level.

Wristband HR monitors are nearly as accurate as chest straps. Optical devices tend to be less accurate when used during vigorous exercises.

Many believe that the newer, wrist based heart rate monitors have achieved almost identical levels of accuracy as their chest strap counterparts with independent tests showing up to 95% accuracy. However, generally speaking pro teams prefer using HR chest straps for the convenience and the fact that they are more accurate than wrist based heart rate monitors. That being said, it is worth pointing out that most athletes don’t like wearing chest strap. Therefore, a better solution (e.g. upper arm) would still be needed. Lastly, optical devices can also be less accurate when used during vigorous activity or when used underwater.

The HR monitoring vendors market is dominated by some players like Polar & Firstbeat.

In the HR monitoring vendors market, Polar and First beat are dominating. In fact, according to Upside Global’s internal data, Polar and First beat capture the majority of the HR monitoring market. In terms of brand recognition, both HR monitoring vendors are top of mind among teams and leagues.

HR systems increasingly being integrated into GPS systems

We have worked with pro teams for 10 years and we have an increasing number of pro teams using both GPS systems integrated with HR monitoring systems (Catapult) and standalone HR monitoring systems (Polar, First Beat). That being said, a large number of those teams prefer using the HR systems integrated with the GPS solution, although being less accurate, rather than the standalone HR systems. Why? Because these teams like the convenience of using one system (GPS + HR) rather than using two separate systems. We expect this trend to continue in the future with more teams embracing the integrated GPS/HR solutions.

Many HR monitoring vendors are targeting the consumer space as well (Polar, Firstbeat, Suunto, Whoop, Wahoo Fitness..).

While the leading HR monitoring vendors have been surviving pro teams and leagues for decades, many of these vendors have also built a solid consumer business where they sell HR chest straps, wristbands used by athletes or amateurs to monitor their HR and fitness. Those include companies such as Polar, Suunto, Whoop, Garmin, Wahoo fitness, just to name a few.

M&A activities in the HR/HRV monitoring market likely to accelerate

In the coming years, like with the outdoor GPS market, we expect to see some major sports performance companies (GPS vendors, Peloton, etc.) going on an M&A spree and acquire some HR/HRV monitoring vendors in order to further differentiate their product offering. So with that in mind, moving forward we expect M&As to accelerate in the HR/HRV monitoring vendor space.

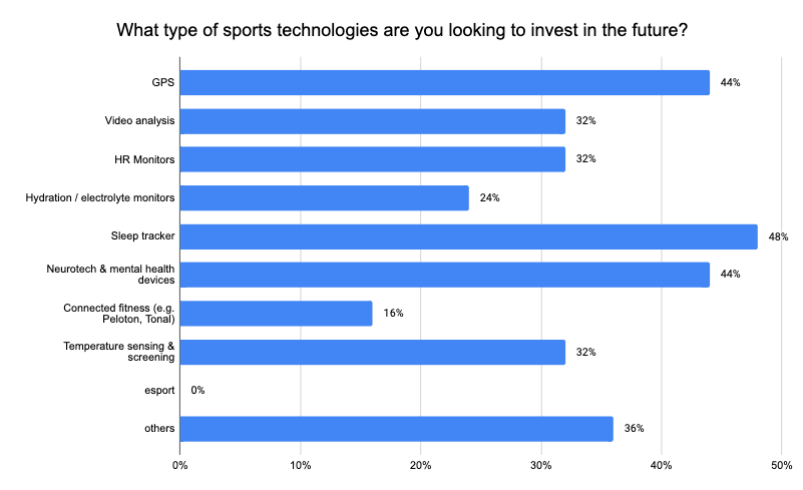

32% of athletic trainers plan to invest in HR systems, according to the 2020 Upside Global survey.

As shown in the graph below, 32% of the athletic trainers we surveyed last year are planning to invest in HR monitoring systems in the future. This compares to 48% of the athletic trainers looking to invest in sleep trackers in the future. 44% of them are also planning to invest in GPS systems and neurotech & mental health devices in the future. This does not come as a surprise as being in quarantine likely affected some players’ sleep and mental health and trainers want to make sure that they can address any mental issues moving forward. 32% of them also planned to invest in video analysis systems and temperature sensing & screening solutions.

Hydration/electrolyte monitoring solutions also gathered a lot of interest with 24% of the respondents indicating their plan to buy hydration/electrolyte monitoring solutions. Lastly, 16% of athletic trainers also indicated their plan to invest in connected fitness (Peloton, Tonal..) in the future.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

Could Hydration, electrolyte and lactate measurement be the next must have sensing capabilities among HR monitoring vendors? Apple could become a big disruptor there.

In the future we expect HR vendors to add new biosensing capabilities such as hydration, lactate, electrolyte, measurement and HRV sensing. It only makes sense to do so as it would allow teams to see the correlation between load and biometric data in order to better assess the health of players and prevent injuries. One of the big drivers here is going to be Apple. Based on our market intelligence, Apple is working on launching a new Apple watch capable of measuring IR based hydration levels, lactate, and blood pressure which will be launched in the next 24 months. Now Apple’s primary goal here is not to focus on the pro sports market but the consumer market. But we believe that this will impact HR monitoring vendors greatly because hydration, lactate, electrolyte, and blood pressure will become the norm in the consumer space. We also expect to see some pro teams adopting the new Apple watch. Therefore, HR monitoring vendors will have no choice but to add such capabilities over time in order to remain competitive and address a growing demand among pro teams and leagues.

Not all major sports leagues use HR monitoring systems

HR monitoring systems are not commonly used across the major sports leagues. For example in the world of pro soccer, not all major soccer teams use HR monitoring systems. However, in sports leagues such as the NBA, the NHL or the NFL, it is pretty common to use HR monitoring systems. The point here is that not all leagues and teams see the value of using HR monitoring systems. And sometimes when teams have to choose between HR and GPS systems they would tend to favor GPS systems over HR monitoring systems due to budget constraints and due to the HR monitoring systems’ location.

The HR/HRV monitoring market ecosystem: From HR/HRV monitoring vendors, AMS to data analytics companies:

The HR/HRV monitoring market is comprised of the following subsegments:

- HR/HRV vendors: Typically those include companies manufacturing HR/HRV monitoring systems. It includes HR/HRV vendors such as Polar, Firstbeat, Suunto, Garmin, Apple, Scosche, Wahoo Fitness, Whoop, and Oura, just to name a few.

- AMS vendors: This category includes companies which provide software enabling teams to manage player’s data (GPS data, biometric data, fatigue…). Key players in the space include companies like Beyond Pulse, Myagonism, Sportgo, Apollo Youth, Kitman labs, Kinduct, Smartabase, Yguara, Pitz, Edge11.

- Algorithms vendors: This includes companies who build advanced algorithms to make sense of data such as HR or HRV. Companies like LifeQ are specialized in this area.

Source: Upside global, Confidential 2021

Key HR/HRV monitoring vendors

- Polar:

Founded: 1977

Amount money raised: TBD

Website: https://www.polar.com/

Investors: TBD

Total employees: 1200

Customers / partners: VFL Wolfsburg, South American soccer teams, Asian soccer teams, just to name a few.

Company/product description: Polar is a manufacturer of sports training computers, particularly known for developing the world’s first wireless HR monitor.

The company is based in Kempele, Finland and was founded in 1977. Polar has approximately 1,200 employees worldwide, it has 26 subsidiaries that supply over 35,000 retail outlets in more than 80 countries. Polar manufactures a range of heart rate monitoring devices and accessories for athletic training and fitness and also to measure HRV.

- First Beat

Founded: 2002

HQ: Jyväskylä, Western Finland, Finland

Amount money raised: TBD

Website: www.firstbeat.com

Investors: Firstbeat has raised a total of — in funding over 1 round. This was a Seed round raised on Apr 30, 2014. Firstbeat is funded by EIT Digital Accelerator.

Total employees: 118

Customers / partners: Over 23,000 athletes representing over 1,000 teams around the world use Firstbeat: 10 national soccer teams (Belgium, England, Spain, Portugal, etc.), 10 MLS teams (LA Galaxy, LAFC, Austin FC, Seattle Sounders FC, etc.), 45 NCAA teams, Premier League teams (Arsenal FC, Liverpool FC, Manchester City FC, Manchester United, Tottenham Spurs FC, etc.), German (Bayern Munich..), French, Brazilian, dutch, Italian (AS Roma, Inter Milan, Lazio, Atalanta, Fiorentina, etc.), Spanish (Atletico Madrid, Sevilla FC, Espanyol, Valencia, etc.) soccer teams. They also work with 19 NHL (Penguins, Bruins, SJ Sharks..) teams, 5 NBA (Chicago Bulls, Warriors, NY Knicks, Orlando Magic, Sacramento Kings) teams.

Company/product description: Firstbeat is the leading provider of physiological analytics for sports and well-being. First Beat was founded 20 years ago in Finland. The innovative use of HRV evolved into the advanced performance analytics that Firstbeat provides today. First Beat works with more than a thousand professional sports teams, millions of consumers, and employees in over 40 countries.

- Suunto:

Founded: 1936

HQ: Vantaa, Southern Finland, Finland

Amount money raised: TBD

Website: www.suunto.com

Investors: TBD

Total employees: 300+

Customers / partners: Mercedes-Benz (Formula E)

Company/product description: Suunto was born in 1936 when Finnish orienteer and engineer Tuomas Vohlonen invented the mass production method for the liquid-filled compass.

Suunto’s headquarters and manufacturing plant is in Vantaa, Finland. Employing more than 300 people worldwide, Suunto products are sold in over 100 countries. The company is a subsidiary of Amer Sports Corporation along with its sister brands Salomon, Arc’teryx, Atomic, Wilson, Precor, Mavic and Nikita.

Suunto is a Finnish company that manufactures and markets sports watches, dive computers, compasses and precision instruments.Suunto employs more than 300 people worldwide, and its products are sold in over 100 countries. Although globally active, the headquarters is placed next to the factory, in which most of the work stages are still handcrafted. Suunto is a subsidiary of Amer Sports, owned since 2019 by the Chinese group Anta Sports, with sister brands Wilson, Atomic, Sports Tracker, Salomon, Precor, Arc’teryx.

The company’s name comes from the Finnish word suunta, meaning “direction” or “path”, or in navigation, “bearing” or “heading”.

- Garmin:

Founded: 1989

HQ: Schaffhausen, Switzerland

Amount money raised: Garmin is registered under the ticker (NASDAQ:GRMN). Garmin has made 2 investments. Their most recent investment was on Mar 31, 2006, when Networks in Motion raised $10M. Garmin has had 1 exit, which was Networks in Motion.

Garmin has acquired 31 organizations. Their most recent acquisition was AeroData on May 25, 2021.

Website: www.garmin.com/en-US/

Investors: Public company

Total employees: 7,238

Customers / partners: TBD

Company/product description: Garmin is a manufacturer of marine, aviation, and consumer technologies suitable to run on the Global Positioning System (GPS). It has delivered more than 100 million products, most of them enabled with GPS, which is far more than any other navigation provider.It also offers HR monitors (smart watches..). Due to their development in wearable technology, they have also been competing with activity tracker and smartwatch consumer developers such as Fitbit and Apple.

- Wahoo Fitness:

Founded: 2009

HQ: Atlanta, Georgia, United States

Amount money raised: Wahoo Fitness has raised a total of — in funding over 1 round. This was a Private Equity round raised on Jul 28, 2018. Wahoo Fitness is funded by Norwest Equity Partners (NEP). Wahoo Fitness was acquired by Rhone Group on Jul 7, 2021.

Website: www.wahoofitness.com

Investors: Wahoo Fitness has invested in Supersapiens on Apr 27, 2021. This investment – Venture Round – Supersapiens – was valued at $13.5M. Wahoo Fitness has acquired The Sufferfest on Jul 8, 2019.

Total employees: 267

Customers / partners: World’s class pro cycling teams (INEOS Grenadiers, Bora Hansgrohe, AG2R Citroen Team, Cofidis, Team DSM, etc.).

Company/product description: Wahoo Fitness is a fitness technology company based in Atlanta, Georgia. Its CEO is Mike Saturnia. Founded in 2009 by Chip Hawkins, Wahoo Fitness has offices in London, Berlin, Tokyo, Reno, Boulder and Brisbane.

Wahoo’s portfolio of cycling industry products includes the KICKR family of Indoor Cycling Trainers and Accessories, the ELEMNT family of GPS Cycling Computers and sport watches, the TICKR family of HR Monitors, SPEEDPLAY Advanced Road Pedal systems and the Wahoo SUF Training App.

- Whoop:

Founded: 2012

HQ: Boston, MA (USA)

Amount money raised: $404.8M

Website: www.whoop.com

Investors: WHOOP has raised a total of $404.8M in funding over 9 rounds. Their latest funding was raised on Aug 30, 2021 from a Series F round. WHOOP is funded by 35 investors. Thursday Ventures and SoftBank Vision Fund are the most recent investors. WHOOP has acquired PUSH on Sep 2, 2021.

Total employees: 578

Customers / partners: Lebron James (NBA/LA Lakers), Steph Curry (Warriors/NBA), Chris Paul (LA Clippers/NBA), Patrick Mahomes (Chiefs/NFL), Alex Killorn (Tampa Bay Lightning/NHL), Michael Phelps (Olympic champion), Dylan Frittelli (Pro Golfer), Nick Watney (Pro Golfer), Navy SEALs, NBPA, NFLPA, MLB, PGA, Premier Lacrosse League, just to name a few.

Company/product description: WHOOP is the performance optimization system that tracks recovery, training, and sleeping hours. The company provides athletes, coaches, and trainers with a continuous understanding of strain and recovery to balance training, reduce injuries, and predict performance. It creates a product that makes individuals and teams perform at a higher level through a deeper understanding of their bodies and daily lives. The WHOOP Strap 3.0 collects physiological data 24/7 to provide an accurate and granular understanding of the body. Whoop also recently entered the smart clothing market with the launch of Whoop 4.0. Aurelian Nicolae, John Capodilupo, and Will Ahmed established WHOOP in 2012 and in Boston, Massachusetts.

- Oura:

Founded: 2013

HQ: Oulu, Finland

Amount money raised: $148.3M

Website: https://ouraring.com/

Investors: ŌURA has raised a total of $148.3M in funding over 8 rounds. Their latest funding was raised on May 4, 2021 from a Series C round.ŌURA is funded by 39 investors. Jazz Venture Partners and Gradient Ventures are the most recent investors.

Total employees: 400

Customers / partners: NBA, NASCAR, UFC, Red Bull, LA Dodgers (MLB), Mariners (MLB), just to name a few.

Company/product description: Oura is a leading sleep tech company, which built a smart ring measuring HRV, sleep quality. Is also built a sleep performance platform, focused on improving sleep that leads to a better life. The Oura Ring and app gives users daily feedback to improve their health, allowing users to better understand their body and reach their goals. Oura Health is a health technology company founded in Oulu, Finland in 2013. In 2018, the company received the Red Dot Awards for communications design and product design. Oura Health is based in Oulu & Helsinki, Finland, and San Francisco, California.

- Scosche:

Founded: 1980

HQ: Oxnard, California, United States

Amount money raised: TBD

Website: www.scosche.com

Investors: TBD

Total employees: 121

Customers / partners: Michele Abbate (Professional race car driver), just to name a few.

Company/product description: Who We Are. Scosche came to life in 1980, when Roger and Scotia “Scosche” Alves started a car audio consulting business in their garage. … We’re still a family owned and run company, with three generations of the Alves family working at the Scosche headquarters in Ventura County, California. Scosche manufactures HR monitors.

- LifeQ:

Founded: 2008

HQ: Alpharetta, Georgia, United States

Amount money raised: $47M

Website: www.lifeq.com

Investors: LifeQ has raised a total of $47M in funding over 2 rounds. Their latest funding was raised on May 26, 2021 from a Series A round. LifeQ is funded by 20 investors. Invenfin, 4Di Capital, Allectus Capital, Mogul Capital, Tenhong Holdings, Analog Devices, Hannover Re, Convergence Partners, Stellar Capital Partners, Nedbank Corporate and Investment Bank, Delos, OneBio Seed Investment Fund, Virgin Group, Lireas, Allen & Co, and Acequia Capital, are among its investors.

Total employees: 71

Customers / partners: Xiaomi, Fossil, Samsung, Suunto, Tag Heuer, Motorola, Mont Blanc.

Company/product description: LifeQ has a mission to create a world where people from all walks of life enjoy optimal health and wellbeing. They are specialized in creating algorithms (HRV..) for wearables (smart watches..).

Recommendations to teams and leagues looking to adopt an HR monitoring solution

Here are some recommendations for teams or leagues looking to adopt a HR monitoring solution:

- Ask yourself some key questions and assess your ideal game style: Teams need to ask themselves some key questions (squad goals, requirements in terms of quality/accuracy, types of data needed, monthly or annual budget) before adopting a HR monitoring solution. Teams also need to find out if athletes would be willing to wear the HR monitoring system depending on the form factor (e.g. chest strap, arm band, etc.) used.

- Adopt a HR system that fits your actual needs: It is critical for teams to pick a HR system to meet their needs. If an HR monitoring system requires the staff members to dedicate too many hours it may not be the right fit for the team.

- Make sure to mix the HR data with other data points to get a better picture of the athletes’ health: As we mentioned earlier, it is critical for teams to aggregate their HR data and mix it with other types of biometric data such as GPS, HRV, etc. By doing so, it will give the coach a better sense of the health of his/her players. Lastly, using HR data is a good starting point but coaches need other reference points such as loads, distance, speeds in order to fully assess players’ health.

- Adopt a data visualization software in order to better visualize the HR data: Sometimes HR vendors do not offer good data visualization software as part of their HR offering. This is why it is important for teams to adopt data visualization tools provided by companies such as Rock Daisy in order to help them better visualize the HR data. There are also a number of Athlete Management Systems (AMS) on the market that display the HR data with GPS data and other tracking systems. Those include companies such as Kitman Labs, Coachme Plus, Smartabase, Kinduct, just to name a few.

- Adopt an injury prevention software in order to prevent injuries: Adopting an injury prevention software that will aggregate both the HR data as well as other types of biometric data (hydration, electrolyte, sleep data/HRV..) in order to fully assess the risk of injury per player, is absolutely critical. Injury prevention software such as Kitman Labs as well as some other AMS systems, use advanced algorithms which help identify patents, and baseline of each player, and therefore can identify when a player is at high risk of injuries based on increased load, increased body temperature, poor sleep quality, or other factors.

- Adopt a HR system that fits into your workflow: This is probably one of the most important points. Whatever HR solution a team decides to adopt the HR system needs to fit into the team’s workflow, meaning that it should not disrupt the routine of the athletic staff, players and make them less productive. Those HR systems should be easy to use, intuitive, and easy for the players to wear. Overall, if a HR system does not meet those criteria it is probably not a good fit for a team.

- Make sure to have staff members (HR/HRV analysts, sports scientists) that can manage your HR systems on a daily basis: Teams also need to have a dedicated person on staff responsible for the HR system. In some cases a HR/HRV analyst would be required to analyze the HR data if the HR system does not provide good insights.

- Focus on HR vendors with great customer service: This is another key factor when buying a HR system. It is important for the team to adopt a HR system with great customer service. Some HR vendors provide staff members who can go on the customer’s site in order to assist teams with any problems. Some HR vendors even have the ability to build custom data to teams. These are the type of HR vendors that teams need to work with when adopting a HR system.

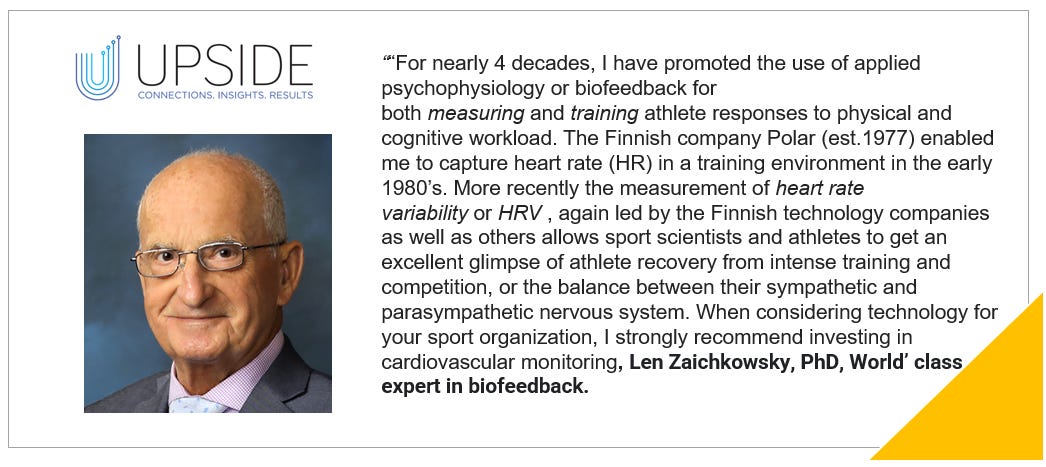

- Adopt a biofeedback program to maximize athletes’ performance: Put in place a biofeedback program to help players get in the zone and maximize sports performance. In our interview with Len Zaichkowsky, PhD, and world’s class biofeedback expert, who has worked for many top teams across the world (Penguins/NHL, Sharks/NHL, Vancouver Canucks/NHL, Spanish national soccer team..), explains during an interview with The Upside that: “For nearly 4 decades, I have promoted the use of applied psychophysiology or biofeedback for both measuring and training athlete responses to physical and cognitive workload. The Finnish company Polar (est.1977) enabled me to capture heart rate (HR) in a training environment in the early 1980’s. More recently the measurement of heart rate variability or HRV , again led by the Finnish technology companies as well as others allows sport scientists and athletes to get an excellent glimpse of athlete recovery from intense training and competition, or the balance between their sympathetic and parasympathetic nervous system. When considering technology for your sport organization, I strongly recommend investing in cardiovascular monitoring.”

- Focus on HR vendors with remote monitoring: In the pandemic world that we are living in, it is also important for teams to work with HR vendors who can provide remote monitoring, meaning the ability for coaches to remotely monitor their players.

- Focus on HR vendors with affordable pricing without long term contracts: Oftentimes we hear from teams that they are locked into long term contracts by some HR vendors. Therefore it is important for teams to look for HR vendors that offer pricing flexibility (1 year contract or monthly payment) as well as affordable pricing options based on the teams’ needs.

- Focus on HR vendors with value add services: As we mentioned before, working with a HR vendor that can visualize the HR data and generate actionable health insights in order to better understand and visualize the HR data is critical as well.

Bottom line: HR and HRV systems have become a critical part of teams’ training and monitoring for sports such as soccer, or American football. Now teams and leagues can choose from a wild variety of HR/HRV vendors today. It is very important for those teams and leagues to carefully assess those HR and HRV vendors in terms of pricing, product quality, HR/HRV accuracy, and vision of the management team, and other factors. Moving forward we expect new emerging players to enter the market in order to disrupt the dominance of the incumbents. This will help fuel innovation in the HR/HRV market which will be a win win situation for the teams and HR/HRV vendors.

Leave A Comment

You must be logged in to post a comment.