VC name: Causeway Media Partners

Headquartered: Cambridge, MA

Founded: 2013

Partners: Bob Higgins, Jasmine Robinson, Mark Wan, and Wyc Grousbeck

Website: www.causewaymp.com/

Sectors: Sports, fitness, gaming, and media

VC type: Growth stage VC

Typical investment range: $5M to $15M (Series B and beyond)

Causeway Media Partners is an investment fund focused on sports, fitness, and related industries. Causeway is committed to forging long-term partnerships with management teams and using Causeway’s extensive network to drive strategic value for their portfolio companies.

Total number of investments: 18

Total number of exits: 4

Recent investments: Omaze, Zwift, Niantic, QuintEvents, Freeletics, Tracksmith

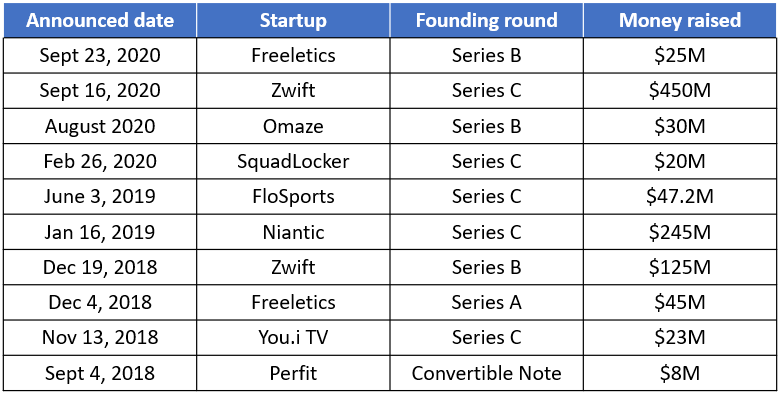

Causeway Media Partners’ latest startup investments:

Source: Crunchbase

This week, we interviewed Jasmine Robinson, Partner at Causeway Media Partners, to discuss her VC’s investment thesis, area of focus, and what she is typically looking for when investing in startups.

Q1. What are the areas of investments that your VC is focusing on? Why? We are focused on investments in sports, fitness, gaming, and media. We view these as high growth categories experiencing significant change and thus see lots of opportunities for value creation in these categories. Additionally, our team and limited partners have deep operating and investing experience in these verticals and so we believe we can be effective partners for management teams building companies in these verticals.

Q2. What are you typically looking for when investing in startups? First and foremost, we look for a high quality management team with a unique point of view on their market and the way they can create value within that market. Second, we look to invest behind great products that end users love. Finally, given our stage of investment, we look for proven growth traction and metrics that suggest a company can continue to scale efficiently going forward.

Q3. What do you think is the state of the sports tech industry after a year with COVID-19? I think the sports market remains strong after a year with COVID-19. The demand we’re seeing to get back to live events is providing a significant tailwind to those businesses that struggled over the last year. I also saw sports properties more open to experimenting with new technology than ever before, which will serve the ecosystem well moving forward. All that being said, the COVID-19 pandemic is far from over and so companies in the sports ecosystem need to continue to actively monitor the impact to their businesses and ensure they have strategies in place to mitigate the impact of further disruptions.

Leave A Comment

You must be logged in to post a comment.